Industry research

Scope

Europe

Companies

147

Table of contents

Statista (May 2022) valued the European market for IT consulting and implementation services at ~$18.4bn in 2021 and projects it to reach ~$26.0bn by 2027, exhibiting a CAGR of ~5.9% during the period

CBI (February 2022) estimates that the European commercial IT outsourcing market grew from ~€9.1bn in 2016 to ~€15.6bn in 2020, making a CAGR of ~14.4%. SaaS (~22.5% CAGR) and IaaS (~31.6% CAGR) contracts were mainly responsible for the total contract value increase

Increasing technological complexity will reinforce the demand for external IT expertise. The proliferation of novel technologies (e.g. AI, IoT) and the high degree of system integrations (interview by Gain.pro) make the role of IT consultants indispensable for business customers (CBI, February 2022)

The ongoing transition from on-premise to cloud-based systems will maintain contract inflow in the foreseeable future (interview by Gain.pro). This development goes hand in hand with ever-increasing worldwide spending on IT, with Gartner (July 2022) expecting that spending on IT services will grow from ~$1.2tn in 2021 to ~$1.4tn in 2023 (~7.2% CAGR)

Versatile opportunities for up- or cross-selling additional services (interview by Gain.pro). Successful initial engagements provide IT consultancies with an edge on the customer’s IT infrastructure, ensuring significant sales potential beyond the digital transformation stage

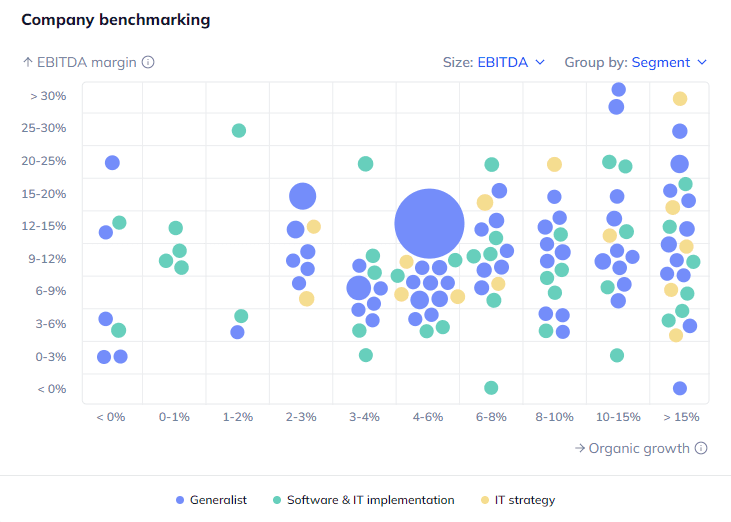

Mature market landscape threatens the long-term sustainability of bottom-line margins. Given the abundance of consultancies and their homogenous offerings, bargaining power is shifting more towards clients (Consultancy.nl, August 2018), thereby putting project economics at risk (interview by Gain.pro)

Structural shortage of talent burdens players’ operational capacity to fully serve demand, due to which potential business opportunities are more frequently turned down. At the same time, the scarcity is pushing salary requirements up, eroding margins as contract prices cannot be adjusted right away (interview by Gain.pro)

Rising data privacy and security concerns withhold organisations from investing in data and analytics projects (MicroStrategy, October 2019). In particular, the European Commission’s ePrivacy Regulation proposes to reduce the overall volume of privacy-related data available to businesses two years after ratification (Clifford Chance, February 2022), already affecting the future value of today’s digitalisation projects for customers

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 147 private companies, incl. financials, ownership details and more.

A view on all 968 deals in the industry

ESG assessments with highlighted ESG outperformers