Industry research

Scope

Europe

Companies

178

Table of contents

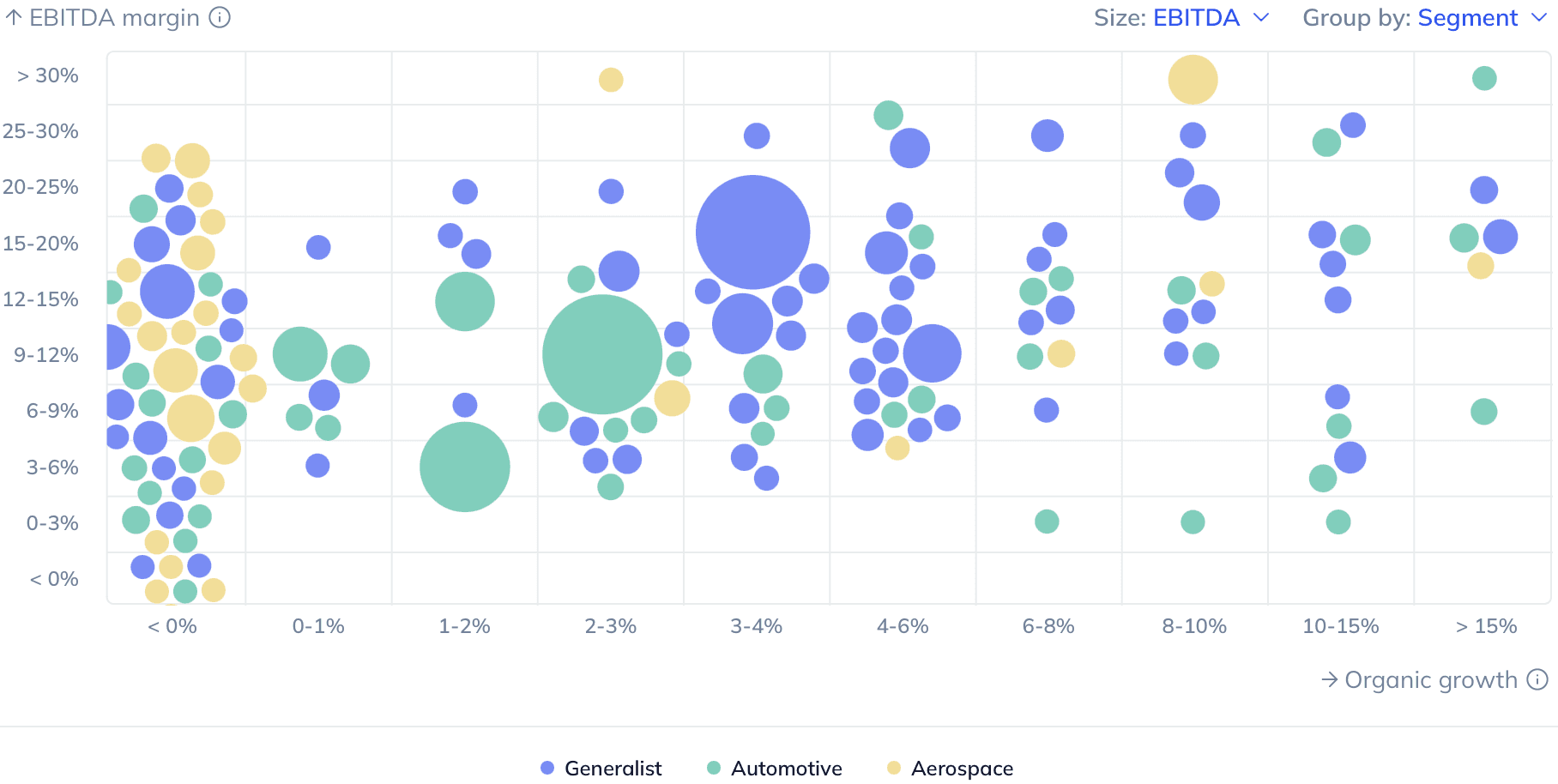

BCG (November 2020) valued the global industrial machinery sector at ~$2.5tn per end-2020.

According to Airbus (July 2022), the number of passenger and freighter aircraft will total ~47,000 in 2041, growing at ~3.5% CAGR 2020-2041.

End-product manufacturers are increasingly outsourcing parts production as it allows them to shorten time to market, accelerate innovations and improve working capital. Furthermore, the trend is expected to go as far as R&D outsourcing and co-participation in the future (interviews by Gain.pro)

Increased industrial parts demand in the medical, agriculture & food and energy verticals driven by secular megatrends. These are (i) the ageing population and advancements in emerging markets, (ii) increasing food demand on the back of the growing world population (Nature Food, July 2021) and (iii) the transition towards green technologies, respectively (interviews by Gain.pro)

Industry 4.0 and robotisation trends are expected to drive efficiency improvements and lower labour costs. Herein, automation will lower parts producers’ dependence on human capital, allowing easier adjustments to cost structures. Furthermore, this will streamline the volatile nature of incoming orders (interviews by Gain.pro)

Rising labour costs will remain a material threat to profitability. Already comprising ~35% of revenue for an average industrial parts manufacturer (interview by Gain.pro), salaries are expected to increase further due to talent shortages and greater technological expertise necessitated by the regulatory landscape (Association of Equipment Manufacturers, January 2022)

Two-way market pressure in the aerospace segment. Aerospace manufacturers attempt to reduce the number of per-platform Tier 1 suppliers for cost efficiencies (Oliver Wyman, March 2015; CIOCoverage), while simultaneously vertically integrating component manufacturers. This could weaken and even eliminate the position for some mid-market suppliers (interviews by Gain.pro)

Disintermediation risk that could result in players’ business moving towards sourcing instead of (co-)development. A case in point is the production of autonomous vehicles. Therein, potential new competitors (including tech giants such as Alphabet) which are familiar with the development of these technologies could replace existing suppliers by moving up the value chain (interviews by Gain.pro)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 178 private companies, incl. financials, ownership details and more.

A view on all 554 deals in the industry

ESG assessments with highlighted ESG outperformers