Industry research

Scope

Europe

Companies

139

Table of contents

The European hotel industry is projected to grow from $110.9bn in 2023 to $118.2bn in 2027, registering a 1.6% CAGR during the period (Statista, January 2023)

European Travel Commission (February 2023) estimated that European travel volumes reached ~75% of the pre-pandemic level in 2022. Domestic and international travel is projected to fully recover by 2024 and 2025, respectively

The post-pandemic travel rebound will support the positive ADR and RevPAR momentum. In particular, the release of local pent-up demand is expected to be reinforced by the return of Chinese travellers, while the cost inflation is largely offset by higher room rates (Fitch, April 2023)

The emergence of “bleisure” and “workation” travel will increase the demand for temporary accommodation (JLL, 2023). The hotel operators can capitalise on this by expanding their longer-stay offering and by enriching traditional work travel offering with recreational facilities and partnerships (Forbes, June 2022)

Margin improvement opportunities arise from process automation and digitalisation (Hospitality Net, September 2022). Innovations like self-check-in machines can reduce labour costs for core hotel operations, while the improved level of service could justify price increases (interview by Gain.pro)

Staffing shortage will maintain its pressure on margins. As European hoteliers struggle to attract and retain employees, many resort to outsourcing partners, which translates into higher long-term operating costs (CoStar, January 2023).

Permanent decline in corporate travel. In their efforts to cut expenses and improve their ecological footprint, most US and European businesses aim to reduce travel per employee by >10%, translating into ~10-20% less spending in real terms (Deloitte, April 2023)

Growing bargaining power of online distribution parties. The consolidation of the online travel agency and booking market gave enormous leverage to dominant platforms (e.g. Booking.com, Expedia) in dealing with accommodation providers. At the same time, the rise of Airbnb and other peer-to-peer booking platforms diverted the demand away from hotel groups towards individuals and boutique hotels (Hotel Tech Report, May 2022).

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

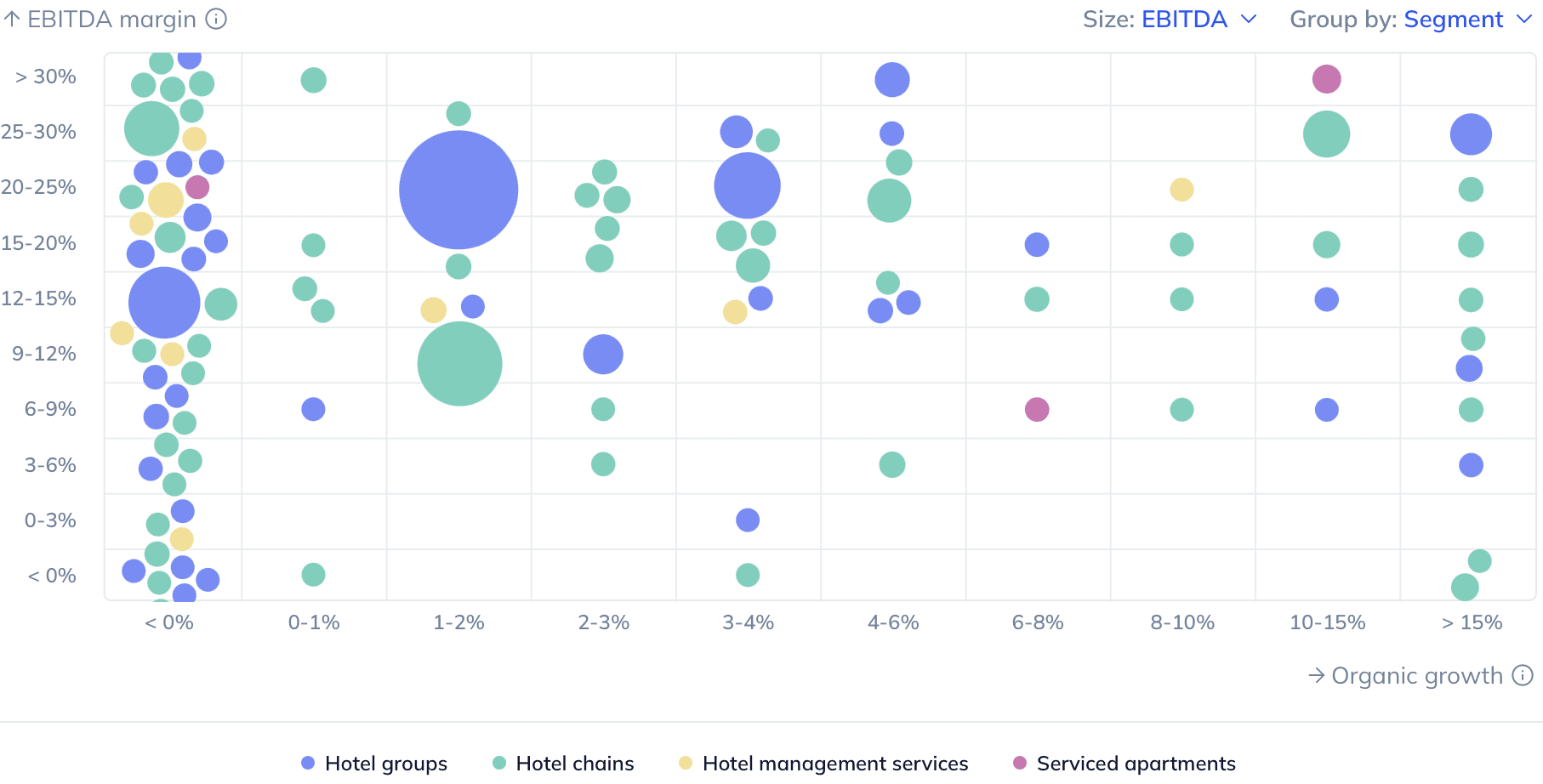

An in-depth look into 139 private companies, incl. financials, ownership details and more.

A view on all 338 deals in the industry

ESG assessments with highlighted ESG outperformers