Industry research

Scope

Europe

Companies

128

Table of contents

CSIL (February 2023) estimated that the European furniture market generated ~€120bn in sales in 2022

Statista (April 2023) estimated that the European indoor furniture market (excluding kitchens) generated ~€145.3bn in 2022 and expects the market to reach ~€186.6bn by 2027 (+5.1% CAGR 2022-2027)

The increased emotional weight consumers put into their living space, accelerated by the COVID-19 pandemic as well as the work-from-home model (which is here to stay), drives the demand for higher-quality furniture which can be sold at more attractive price points (interview by Gain.pro; Forbes, March 2023)

The relatively conservative home furnishing market is set significantly benefit from the digitisation of the sector and the subsequent availability of data to better tailor product offerings and services as well as improve product design and marketing ROIs leading to bottom-line improvements (interview by Gain.pro; DFS, October 2022)

Opportunities for retailers to boost both in-store and webshop traffic by optimising the customer’s experience. Through the seamless integration between offline and online sales channels, consumers can physically test and experience home furnishings to subsequently order the pieces online (interview by Gain.pro)

As interest rates rise (Reuters, May 2023) and housing prices decrease (Eurostat, April 2023), Europeans are expected to move less. With moving being a typical moment to replace furniture, this will pressure players’ top-line upside (interview by Gain.pro)

The current uncertain economic climate, with high inflation (+7.0% YoY in April 2023 for EU; Eurostat, May 2023) and rising energy prices, pressures consumers' purchasing power (CBS, May 2022). As a result, consumers are expected to spend less on discretionary goods such as furniture (interviews by Gain.pro; CSIL, February 2023)

Designers and retailers stocked up during the pandemic, in times when container and raw material prices skyrocketed. As the COVID-induced demand is now falling, this means players are left with expensive inventories and decreased volume (interviews by Gain.pro; Furniture Today, January 2023)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

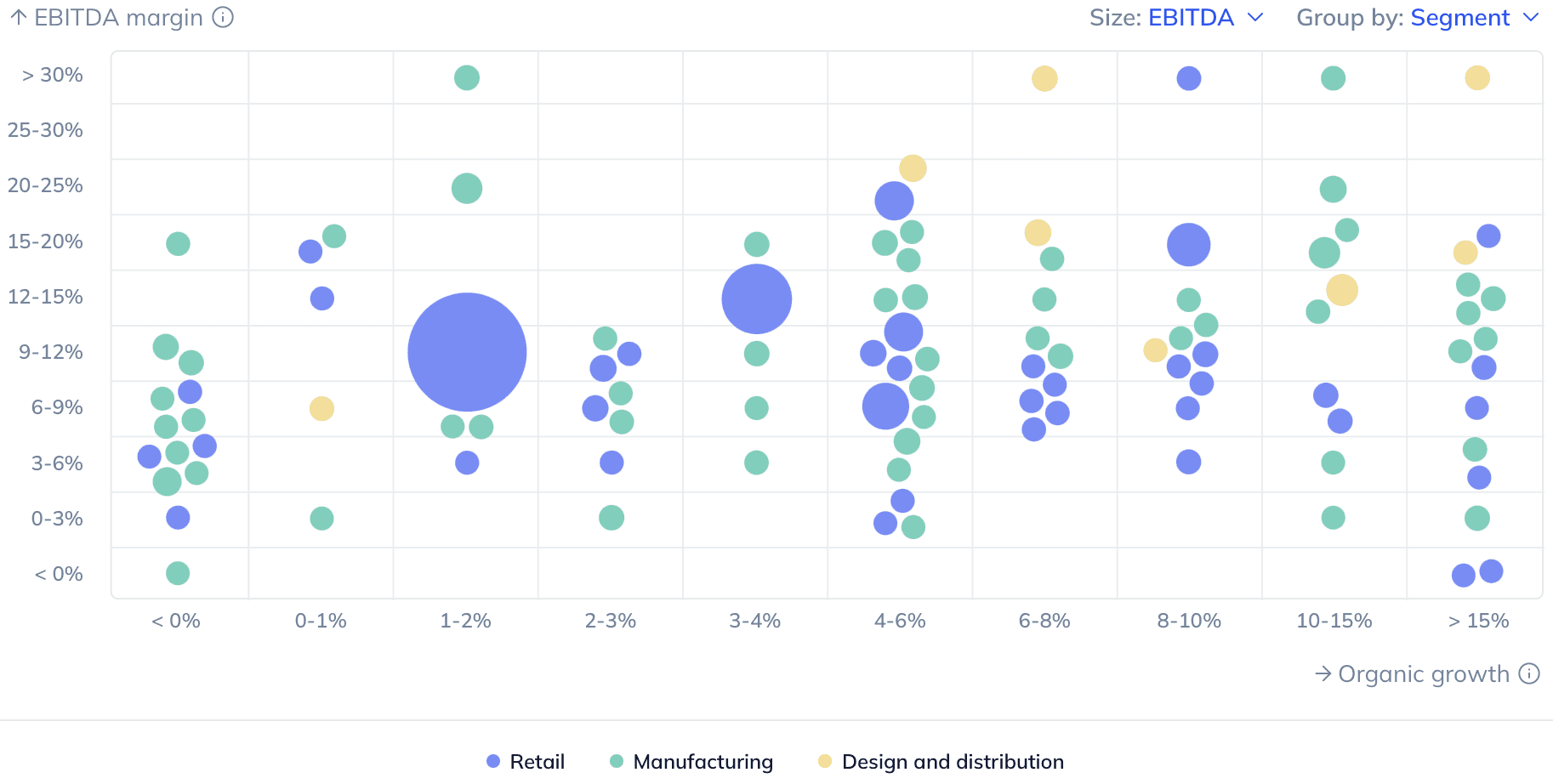

An in-depth look into 128 private companies, incl. financials, ownership details and more.

A view on all 246 deals in the industry

ESG assessments with highlighted ESG outperformers