Industry research

Greenhouses market

Greenhouses market

Greenhouses market

Scope

Europe

Companies

31

Deals

73

Revenue growth

6-8%

Cyclicality

Cyclical

ESG risk

Medium/Low

Table of contents

Key takeaways

Key takeaways

The European greenhouses market comprises businesses engaged in the construction of greenhouse structures for horticulture and floriculture applications or the production of associated equipment, such as climate control systems (e.g. ventilation, lighting), irrigation systems and logistics equipment (e.g. harvesting trolleys, forklifts), among others. As such, we segmented the market into: (i) construction and (ii) equipment.

The average delivery timeline for greenhouses of ~5-10ha is ~8-12 months, depending on the project scale, complexity and associated financing needs. The average order book is filled for ~3-6 months (interview by Gain.pro). Part of the preparation includes requesting quotations from suppliers. Herein, some incumbents choose to buy steel in the open market, while others make use of price and volume contracts for aluminium, locking in the price for ~3-4 months ahead. Generally, raw material prices may fluctuate ~2% between pricing at the quotation date and the actual invoice at order (interview by Gain.pro). For turn-key projects with complex systems, construction players must closely cooperate with equipment businesses to ensure seamless integration, making these partnerships rather long term in nature (interview by Gain.pro). For the final installation stage, some businesses rely on outsourcing partners, while others use in-house installation capabilities. Projects have an international nature and are mostly won through directly awarded contracts, regardless of the size of the project. Networking is usually the go-to channel for new contracts. Tenders do exist but are more common for specific customers (e.g. a fund). With increasing order sizes and demand for more complicated turn-key projects, larger companies in the sector have found challenges in professionalising their project management (interview by Gain.pro). Key KPIs to win projects relate to price (e.g. lower price per m² for additional coverage), quality (e.g. degree of innovativeness, in-house technologies), supply reliability (e.g. some larger generalists offer maintenance services as well) and reputation (interview by Gain.pro).

The greenhouses industry is dominated by Dutch suppliers, with ~90% of all glass greenhouses globally originating in the Netherlands (AVAG, March 2024 ). In recent years, the Dutch market underwent significant consolidation, with the number of active greenhouse businesses going down by ~50% in 2010-2020 (interview by Gain.pro). This is illustrated by Atrium Agri, the country’s market leader established in 2019, by combining 3 major players (i.e. Havecon, PB tec, VB). Subsequently, Atrium Agri continued acquiring smaller peers, reaching ~€400m in annual sales (Het Financieele Dagblad, November 2022 ). With the domestic market reaching maturity and struggling with rising energy bills, Dutch players need to amass additional scale to facilitate major international projects. Another driver for M&A stems from the shortage of technical personnel (interview by Gain.pro). Nevertheless, some industry executives expect a slowdown in M&A activity and an uptick in JVs due to the high valuations in the market.

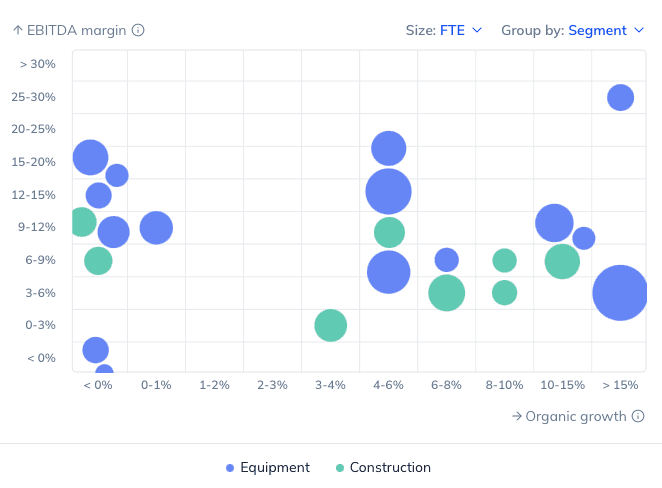

PE-led appetite has been moderate with ~35% of identified assets being sponsor-backed (March 2024). The market’s project-based income streams and exposure to economic cycles act as key detractors. While equipment manufacturers are less prone to market swings, their CAPEX associated with continuous product development affects projected cash returns. For example, climate system developer Priva spent on average ~16% of its revenue on CAPEX between 2020-2022. In addition, an industry executive (interview by Gain.pro) mentioned that EBITDA margins are capped at ~10% for the greenhouse construction segment. Furthermore, identified suppliers of cultivation equipment register lagging gross margin figures due to a high bill of materials. This consequently leaves few internal opportunities to drive profitability ratios, as illustrated by median EBITDA margins of ~6-9% (2018–2022).

The ESG agenda mainly revolves around environmental and governance factors. With the agricultural industry being a key contributor to the EU’s carbon footprint, farmers and cultivators are increasingly urged to invest in making their operations more sustainable. Identified greenhouse constructors are well-positioned to capitalise on this development, as advanced greenhouses using renewable energy and integrated systems can lower emissions per tonne harvested by ~35%. From a governance perspective, dissatisfaction among farmers is increasing as they need to prioritise new investments to meet the EU’s Nature Restoration Law. While this may lead to increased demand for greenhouses, it also creates higher uncertainty regarding farming earning models.

The European greenhouses market comprises businesses engaged in the construction of greenhouse structures for horticulture and floriculture applications or the production of associated equipment, such as climate control systems (e.g. ventilation, lighting), irrigation systems and logistics equipment (e.g. harvesting trolleys, forklifts), among others. As such, we segmented the market into: (i) construction and (ii) equipment.

The average delivery timeline for greenhouses of ~5-10ha is ~8-12 months, depending on the project scale, complexity and associated financing needs. The average order book is filled for ~3-6 months (interview by Gain.pro). Part of the preparation includes requesting quotations from suppliers. Herein, some incumbents choose to buy steel in the open market, while others make use of price and volume contracts for aluminium, locking in the price for ~3-4 months ahead. Generally, raw material prices may fluctuate ~2% between pricing at the quotation date and the actual invoice at order (interview by Gain.pro). For turn-key projects with complex systems, construction players must closely cooperate with equipment businesses to ensure seamless integration, making these partnerships rather long term in nature (interview by Gain.pro). For the final installation stage, some businesses rely on outsourcing partners, while others use in-house installation capabilities. Projects have an international nature and are mostly won through directly awarded contracts, regardless of the size of the project. Networking is usually the go-to channel for new contracts. Tenders do exist but are more common for specific customers (e.g. a fund). With increasing order sizes and demand for more complicated turn-key projects, larger companies in the sector have found challenges in professionalising their project management (interview by Gain.pro). Key KPIs to win projects relate to price (e.g. lower price per m² for additional coverage), quality (e.g. degree of innovativeness, in-house technologies), supply reliability (e.g. some larger generalists offer maintenance services as well) and reputation (interview by Gain.pro).

The greenhouses industry is dominated by Dutch suppliers, with ~90% of all glass greenhouses globally originating in the Netherlands (AVAG, March 2024 ). In recent years, the Dutch market underwent significant consolidation, with the number of active greenhouse businesses going down by ~50% in 2010-2020 (interview by Gain.pro). This is illustrated by Atrium Agri, the country’s market leader established in 2019, by combining 3 major players (i.e. Havecon, PB tec, VB). Subsequently, Atrium Agri continued acquiring smaller peers, reaching ~€400m in annual sales (Het Financieele Dagblad, November 2022 ). With the domestic market reaching maturity and struggling with rising energy bills, Dutch players need to amass additional scale to facilitate major international projects. Another driver for M&A stems from the shortage of technical personnel (interview by Gain.pro). Nevertheless, some industry executives expect a slowdown in M&A activity and an uptick in JVs due to the high valuations in the market.

PE-led appetite has been moderate with ~35% of identified assets being sponsor-backed (March 2024). The market’s project-based income streams and exposure to economic cycles act as key detractors. While equipment manufacturers are less prone to market swings, their CAPEX associated with continuous product development affects projected cash returns. For example, climate system developer Priva spent on average ~16% of its revenue on CAPEX between 2020-2022. In addition, an industry executive (interview by Gain.pro) mentioned that EBITDA margins are capped at ~10% for the greenhouse construction segment. Furthermore, identified suppliers of cultivation equipment register lagging gross margin figures due to a high bill of materials. This consequently leaves few internal opportunities to drive profitability ratios, as illustrated by median EBITDA margins of ~6-9% (2018–2022).

The ESG agenda mainly revolves around environmental and governance factors. With the agricultural industry being a key contributor to the EU’s carbon footprint, farmers and cultivators are increasingly urged to invest in making their operations more sustainable. Identified greenhouse constructors are well-positioned to capitalise on this development, as advanced greenhouses using renewable energy and integrated systems can lower emissions per tonne harvested by ~35%. From a governance perspective, dissatisfaction among farmers is increasing as they need to prioritise new investments to meet the EU’s Nature Restoration Law. While this may lead to increased demand for greenhouses, it also creates higher uncertainty regarding farming earning models.

The European greenhouses market comprises businesses engaged in the construction of greenhouse structures for horticulture and floriculture applications or the production of associated equipment, such as climate control systems (e.g. ventilation, lighting), irrigation systems and logistics equipment (e.g. harvesting trolleys, forklifts), among others. As such, we segmented the market into: (i) construction and (ii) equipment.

The average delivery timeline for greenhouses of ~5-10ha is ~8-12 months, depending on the project scale, complexity and associated financing needs. The average order book is filled for ~3-6 months (interview by Gain.pro). Part of the preparation includes requesting quotations from suppliers. Herein, some incumbents choose to buy steel in the open market, while others make use of price and volume contracts for aluminium, locking in the price for ~3-4 months ahead. Generally, raw material prices may fluctuate ~2% between pricing at the quotation date and the actual invoice at order (interview by Gain.pro). For turn-key projects with complex systems, construction players must closely cooperate with equipment businesses to ensure seamless integration, making these partnerships rather long term in nature (interview by Gain.pro). For the final installation stage, some businesses rely on outsourcing partners, while others use in-house installation capabilities. Projects have an international nature and are mostly won through directly awarded contracts, regardless of the size of the project. Networking is usually the go-to channel for new contracts. Tenders do exist but are more common for specific customers (e.g. a fund). With increasing order sizes and demand for more complicated turn-key projects, larger companies in the sector have found challenges in professionalising their project management (interview by Gain.pro). Key KPIs to win projects relate to price (e.g. lower price per m² for additional coverage), quality (e.g. degree of innovativeness, in-house technologies), supply reliability (e.g. some larger generalists offer maintenance services as well) and reputation (interview by Gain.pro).

The greenhouses industry is dominated by Dutch suppliers, with ~90% of all glass greenhouses globally originating in the Netherlands (AVAG, March 2024 ). In recent years, the Dutch market underwent significant consolidation, with the number of active greenhouse businesses going down by ~50% in 2010-2020 (interview by Gain.pro). This is illustrated by Atrium Agri, the country’s market leader established in 2019, by combining 3 major players (i.e. Havecon, PB tec, VB). Subsequently, Atrium Agri continued acquiring smaller peers, reaching ~€400m in annual sales (Het Financieele Dagblad, November 2022 ). With the domestic market reaching maturity and struggling with rising energy bills, Dutch players need to amass additional scale to facilitate major international projects. Another driver for M&A stems from the shortage of technical personnel (interview by Gain.pro). Nevertheless, some industry executives expect a slowdown in M&A activity and an uptick in JVs due to the high valuations in the market.

PE-led appetite has been moderate with ~35% of identified assets being sponsor-backed (March 2024). The market’s project-based income streams and exposure to economic cycles act as key detractors. While equipment manufacturers are less prone to market swings, their CAPEX associated with continuous product development affects projected cash returns. For example, climate system developer Priva spent on average ~16% of its revenue on CAPEX between 2020-2022. In addition, an industry executive (interview by Gain.pro) mentioned that EBITDA margins are capped at ~10% for the greenhouse construction segment. Furthermore, identified suppliers of cultivation equipment register lagging gross margin figures due to a high bill of materials. This consequently leaves few internal opportunities to drive profitability ratios, as illustrated by median EBITDA margins of ~6-9% (2018–2022).

The ESG agenda mainly revolves around environmental and governance factors. With the agricultural industry being a key contributor to the EU’s carbon footprint, farmers and cultivators are increasingly urged to invest in making their operations more sustainable. Identified greenhouse constructors are well-positioned to capitalise on this development, as advanced greenhouses using renewable energy and integrated systems can lower emissions per tonne harvested by ~35%. From a governance perspective, dissatisfaction among farmers is increasing as they need to prioritise new investments to meet the EU’s Nature Restoration Law. While this may lead to increased demand for greenhouses, it also creates higher uncertainty regarding farming earning models.

Company benchmarking

Company benchmarking

Market growth

Market growth

The global area of greenhouse cultivation is expected to increase from ~600k ha in 2018 to ~780k ha by 2025 (+3.8% CAGR; Rabobank, December 2020), with low-tech greenhouses accounting for ~700k ha (+3.5% CAGR) and high-tech greenhouses for ~80k ha (+6.9% CAGR)

According to Rabobank (March 2021 ), the global market for greenhouses will grow at a ~6% CAGR in 2021-2026

An industry executive (interview by Gain.pro) projects the European greenhouses market to grow at a ~3-7% CAGR in the medium term

An industry executive (interview by Gain.pro) projects the European greenhouses market to grow at a ~3-7% CAGR in the medium term

Positive drivers

Positive drivers

Rising global population necessitates increased agricultural efficiency. FAO (July 2023) estimates that global food consumption will increase by ~15% in 2023-2032. Greenhouses help to address this gap with higher yield per cultivated area and extended produce shelf life with reduced transportation (interview by Gain.pro; Het Financieele Dagblad, November 2022)

Increasing long-term demand for healthy food products to be available year-round, for which consumers are willing to pay higher prices (interview by Gain.pro; CBI, December 2023). More particularly, Asian countries increasingly target a self-sufficient supply chain of safe vegetables (interview by Gain.pro)

The growing share of high-tech greenhouse projects leads to new and more predictable revenue streams for identified players. For instance, clients in Saudi Arabia tend to request multi-year contracts to cover for maintenance services (interview by Gain.pro)

Negative drivers

Negative drivers

Volatile energy prices limit the economical benefits of greenhouse farming, thereby reducing long-term demand. For example, European growers had to skip the winter cultivation of tomatoes amid the 2022 energy crisis due to higher heating and lighting costs (Hort News, October 2022; Het Financieele Dagblad, January 2023)

Overcrowding risk of greenhouse (equipment) supply flooding the market, which might cause margins to shrink in the mid-term. More specifically, players focused on established machinery for crops commonly grown in greenhouses (e.g. for lettuce) are at a disadvantage, as that market is rather saturated (interview by Gain.pro)

Governmental- and policy-related risks may slow down or dissuade investors from investing in large turn-key plants. With a large part of the incumbents’ revenues being derived from international sales, changes in policies or discontinued subsidies may have a severe impact on order books (interview by Gain.pro)

Fill out the form to request your copy of the Greenhouses market industry report

Fill out the form to request your copy of the Greenhouses market industry report

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 31 private companies, incl. financials, ownership details and more.

A view on all 73 deals in the industry

ESG assessments with highlighted ESG outperformers

Discover hundreds of niche industry reports on Gain.pro

Deep dive into additional industries to understand their market outlook, positive and negative drivers, and more!

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved