Industry research

Scope

Europe

Companies

78

Table of contents

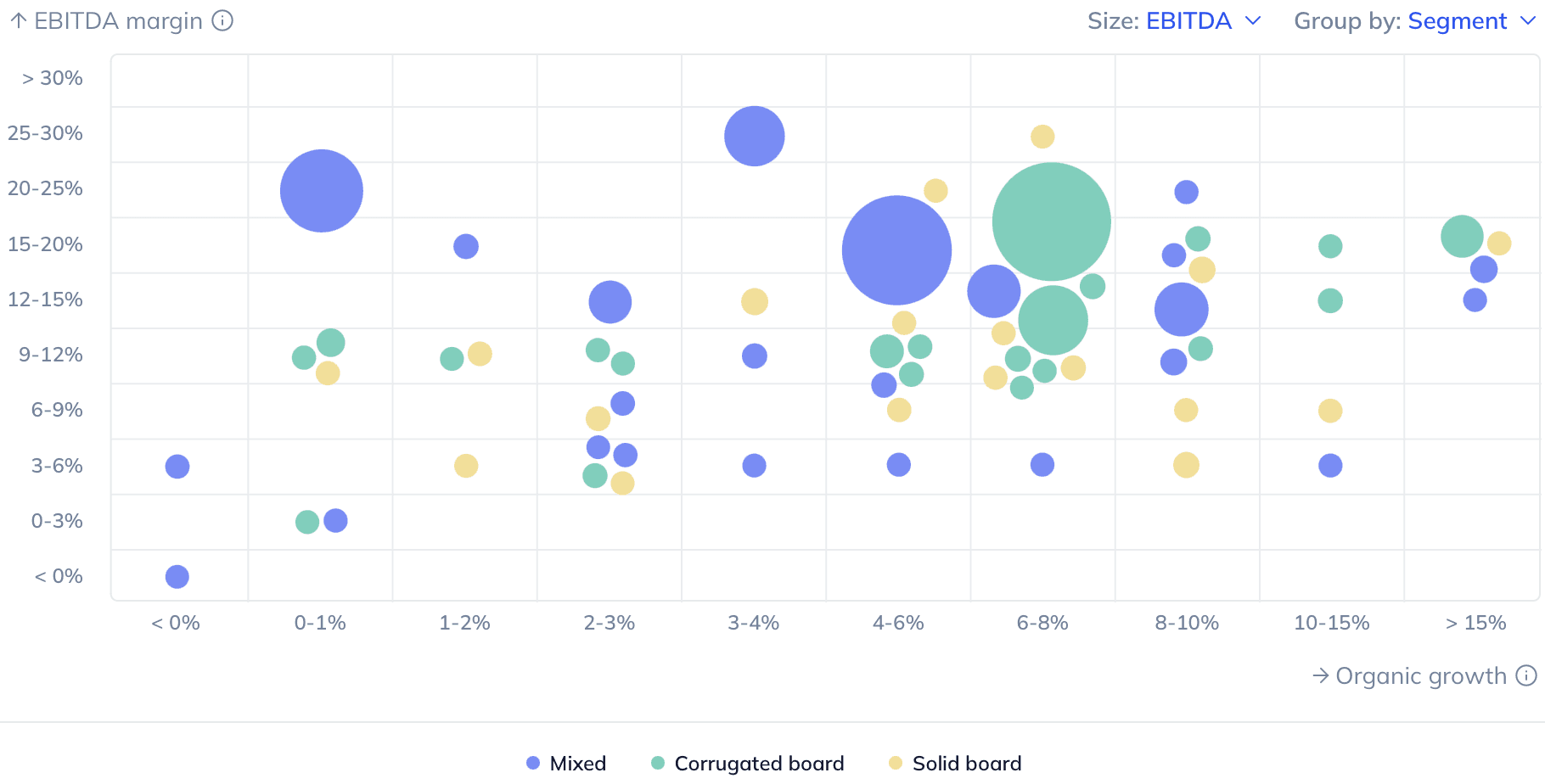

Statista (March 2023) estimates that the global board packaging industry’s market value amounted to ~€182.2bn in 2021 and anticipates it to reach ~€232.1bn by 2026 (+5.0% CAGR 2021-2026)

Industry executives interviewed by Gain.pro (April 2023) estimate the European solid board packaging market to be valued between ~€13-18bn, growing between ~2-4% YoY in the medium term

Increasing sustainability concerns by consumers and governments create a market shift from plastic- to paper-based packaging (McKinsey & Company, January 2020). Herein, a broad range of food- (e.g. vegetables, fruit) and non-food (e.g. detergents) products are packaged in paper-based alternatives which offer greater recycling rates than plastic (interviews by Gain.pro; Two Sides, May 2020)

The rising number of single-person households in the EU (+29% between 2009-2021) triggers changing consumption patterns towards smaller-portioned products, thereby boosting packaging demand (Eurostat, May 2022). Similarly, population growth on the back of an ageing society supports packaging volume growth in the long term (interview by Gain.pro)

The COVID-19-induced surge in e-commerce is expected to persist in the post-pandemic world, with corrugated board packaging producers set to benefit the most (McKinsey & Company, May 2023; interview by Gain.pro)

The changing regulatory environment (e.g. EU’s packaging waste regulation), trying to limit overpackaging and reduce unnecessary packaging, is likely to pressure board packaging volumes in the medium- to long-term as packaging reusability (e.g. rigid alternatives) is favoured over recyclability (interview by Gain.pro; European Commission, November 2022). Particularly, younger generations are willing to limit and adjust their consumption to counteract climate change (Blue Horizon, May 2023)

Margin pressure in an increasingly competitive environment, coming both from upstream paper mill operators (e.g. Billerud) entering the value chain as well as from emerging print brokers who provide more extensive offerings and are able to undercut traditional producers in terms of price (interviews by Gain.pro)

Conscious consumerism leading to lower volumes of disposable packaging on a per capita basis, with board and paper packaging representing the main packaging waste material across the EU (~41% of all waste generated in 2020; Eurostat, March 2023). Board packaging waste declined for the first time since the last financial crisis during COVID-19, which is expected to persist in the coming years (interview by Gain.pro; Umwelt Bundesamt, September 2022)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 78 private companies, incl. financials, ownership details and more.

A view on all 258 deals in the industry

ESG assessments with highlighted ESG outperformers