Industry research

Scope

US

Companies

115

Table of contents

What does the Education market landscape look like in the US?

The US market is highly fragmented, with established players striving to gain a competitive edge through tailored learning experiences and by focusing on high-quality service offerings. Herein, a strong physical presence remains crucial to successfully compete in targeted regions. Further consolidation is expected as institutions acquire complementary targets to enhance scale efficiencies and value for students and professionals amid rising operational costs and pressurized US enrollment figures.

What is the level of investor activity in the US Education industry?

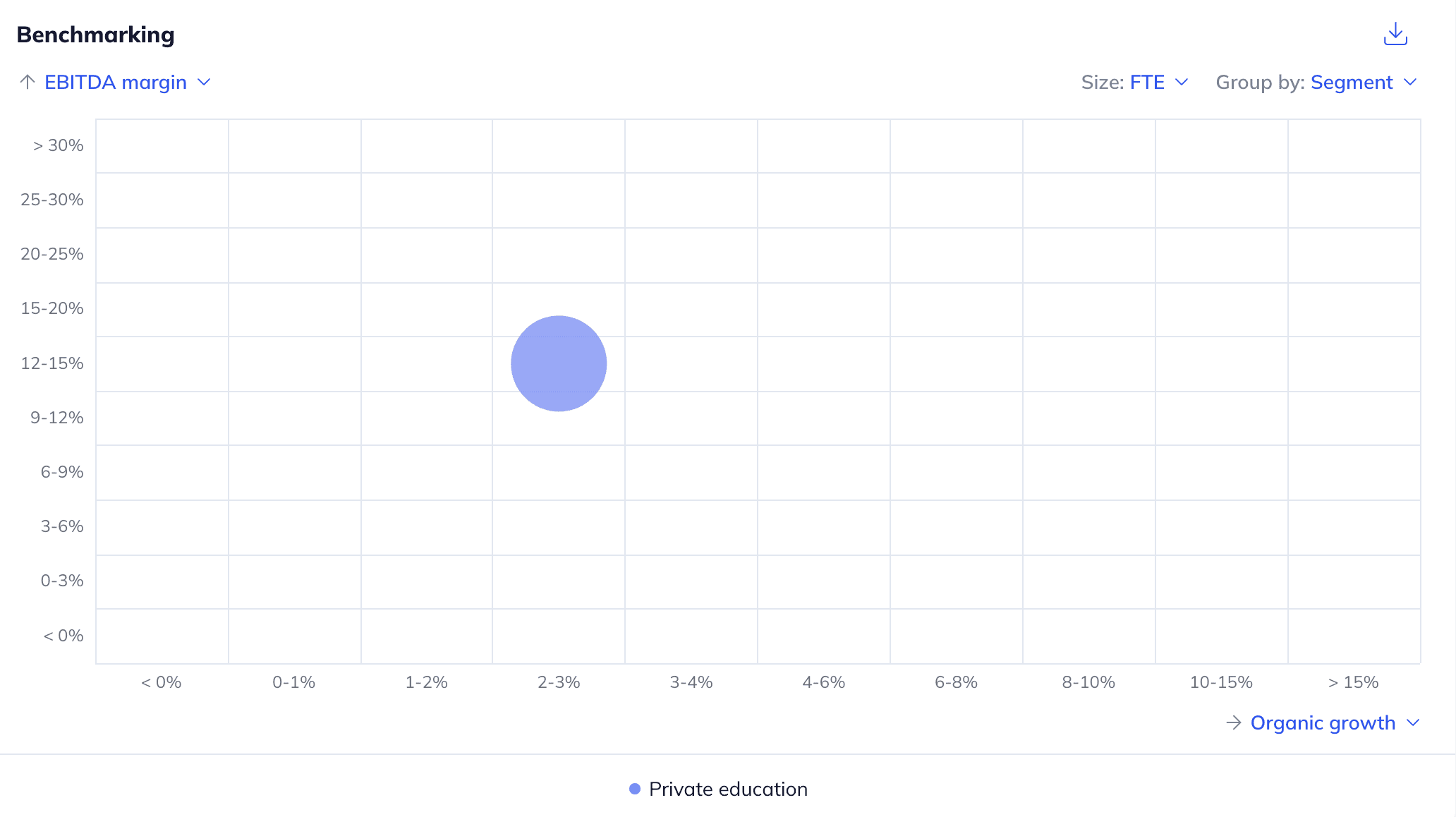

PE-led interest has been moderate, with ~28% of identified assets being sponsor-backed (February 2025). Investors are primarily attracted by (i) the increasing preference for private education driven by its high-quality characteristics, (ii) the need for re- and upskilling due to a rising number of job transitions and (iii) AI-powered tools that enhance personalized learning amid increasing digital education adoption. On the other hand, (i) the US government plans to lower educational funding for student loans and low-income individuals which affects private education demand, (ii) the slow adoption of educational technology amid an aging US teacher base and (iii) the rise of more cost-effective (online) education options serve as detractors for investors.

What are the key ESG considerations in the US Education industry?

ESG topics mainly revolve around social and, to a lesser extent, environmental aspects. Educational institutions can serve a pivotal role in eliminating inequalities among the US population. To enhance equal educational opportunities, incumbents financially support students through scholarships and discounts, establish partnerships to improve equality and provide guidance for young graduates entering the job market. On the environmental side, identified players contribute to greenhouse gas emissions and generate substantial waste streams through their physical locations. To combat this, incumbents increasingly shift towards renewable energy alternatives and seek to reuse and recycle materials across their facilities.

According to Morgan Stanley (June 2023), the global education market was estimated at ~$6tn in 2022 and is forecasted to be worth ~$8tn by 2030 (+3.7% CAGR 2022-2030)

The global professional development market generated ~$55.1bn in revenue in 2024 and is expected to reach ~$81.3bn by 2029 (+8.1% CAGR; Technavio, January 2025)

The increasing shift toward private education, fueled by parents' concerns over rising standardization and the lack of social and emotional learning in public schools. This trend is further accelerated by the US government increasingly supporting private schooling under the banner of parental rights (The Washington Post, November 2024; EducationWeek, July 2024; The New York Times, June 2024)

The growing willingness of workers to change careers drives record-high job transitions (e.g. ~51% of US workforce considering seeking a new job) and subsequently results in greater adoption of lifelong learning. The ever-evolving labor market demands ongoing professional development, with employers increasingly covering the costs for their employees (The Wallstreet Journal, December 2024; Financial Times, July 2024; McKinsey & Company, July 2023; Gallup, July 2023)

The emergence of AI-powered tools in education enables education providers to create tailored courses, enhance engagement at scale and reduce staff workloads. Education can bridge financial and capacity gaps through these technologies, offering personalized learning experiences that enhance value for students (World Economic Forum, May 2024; McKinsey & Company, June 2022)

The US government plans to reduce support for its educational system (e.g. significant cuts to programs at the US Department of Education) and lower education funding by reducing student loans and support for low-income students. This lowers their disposable income and ultimately decreases demand for private education (OPB, February 2025; BBC, February 2025)

The slow adoption of educational technology in classrooms due to an aging teacher workforce, a trend worsened by the higher attrition rate among younger teachers, which ultimately limits educational innovation and caps student engagement. US teachers of age struggle to keep pace with technological developments, while educational institutions remain uncertain about the successful integration of new technologies (e.g. AI) into their workflows (interview by Gain.pro; Deloitte, April 2024; McKinsey & Company, March 2023)

The growth of free and freemium educational platforms offering greater cost-effectiveness and scalability impacts customer demand and reduces pricing power for incumbents. At the same time, the education market faces increasing pressure from unfavorable demographics (e.g. declining birth rates) and stricter immigration policies, further shrinking the addressable market (interview by Gain.pro; BBC, January 2025; CDC, April 2024)

With the full report, you’ll gain access to:

Detailed assessments of the market outlook

Insights from c-suite industry executives

A clear overview of all active investors in the industry

An in-depth look into 115 private companies, incl. financials, ownership details and more.

A view on all 156 deals in the industry

ESG assessments with highlighted ESG outperformers