| #1 PITCHBOOK ALTERNATIVE

The platform of choice for today’s dealmakers

The platform of choice for today’s dealmakers

The platform of choice for today’s dealmakers

Gain.pro is built for better data, deeper insights, and real workflow automation. We are the next-gen, AI-native platform to win more and better deals.

Gain.pro is built for better data, deeper insights, and real workflow automation. We are the next-gen, AI-native platform to win more and better deals.

Gain.pro is built for better data, deeper insights, and real workflow automation. We are the next-gen, AI-native platform to win more and better deals.

Trusted by >$1 trillion of private capital, 100% of MBB/Big-Four and >70%

top-20 M&A houses

Trusted by >$1 trillion of private capital, 100% of MBB/Big-Four and >70% top-20 M&A houses

Trusted by >$1 trillion of private capital, 100% of MBB/Big-Four and >70% top-20 M&A houses

Why leading dealmakers are choosing Gain.pro over PitchBook

Why leading dealmakers are choosing Gain.pro over PitchBook

Why leading dealmakers are choosing Gain.pro over PitchBook

Legacy tools weren’t built for today’s dealmakers. Gain.pro gives you the speed, clarity, and confidence to win more deals.

Legacy tools weren’t built for today’s dealmakers. Gain.pro gives you the speed, clarity, and confidence to win more deals.

Legacy tools weren’t built for today’s dealmakers. Gain.pro gives you the speed, clarity, and confidence to win more deals.

Better data on private companies

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Better data on private companies

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Unparalleled sector research

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Unparalleled sector research

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Unique interconnected data

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Unique interconnected data

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Superior investor profiles

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Superior investor profiles

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

#1 on international data

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

#1 on international data

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

A source for everything

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

A source for everything

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

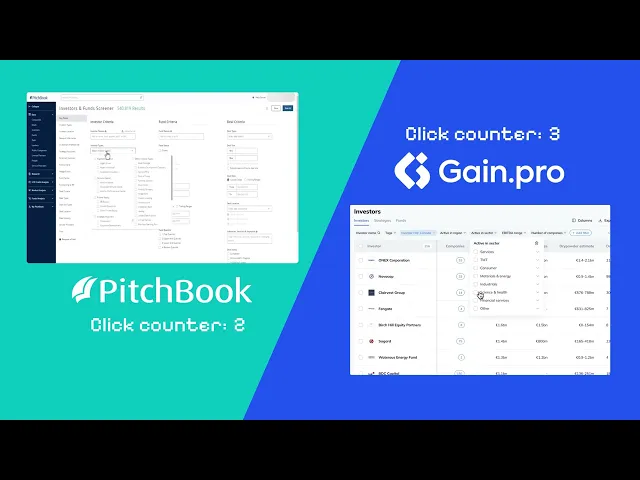

Intuitive, modern UX/UI

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Intuitive, modern UX/UI

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

AI Native tools

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

AI Native tools

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Value and customer outcomes

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Value and customer outcomes

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Better data on private companies

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Unparalleled sector research

Human-led analysis in a typical "DD" style. Layered CEO insights, rumoured deals and bottom-up company, market and investor analysis on a segmented market.

Offers analyst-led research, primarily delivered through static, PDF-based reports.

Unique interconnected data

Entire private market ecosystem: companies, investors, advisors, lenders, transactions, conferences, and people data, seamlessly linked in one platform, to provide a holistic

view.

Fragmented data with weak linkages makes analysis slow and less efficient. Acquired private credit database LCD and has been integrating this into Pitchbook.

Superior investor profiles

Clear, structured profiles showing the full context of funds, strategies, deals, and networks, making comparison and navigation easy.

Fragmented data with weak linkages makes analysis slow and less efficient. Acquired private credit database LCD and has been integrating this into Pitchbook.

#1 on international data

Leader in international data, surfacing SEC-like filings outside the US and local disclosures often overlooked by competitors. Especially strong in Europe and mid-market segments.

US-centric with stronger VC and funding round data. Weaker coverage outside of the US.

A source for everything

Every data point is sourced and auditable, ensuring full transparency and trust.

Supporting reliable decision making.

Less transparent sourcing and audit trails makes validation harder.

Intuitive, modern UX/UI

Fast, intuitive interface with interconnected

data and instant answers so teams can move fast with minimal training.

Complex interface with manual steps and fragmented workflows slow down teams and make adoption harder.

AI Native tools

Is built as an AI-native platform with features like natural language search, automated sourcing, two-way CRM synchronization, and off-the-shelf, standard bulk data services.

Offers a traditional SaaS feature set including 1-way CRM integration and, on request, bulk data services.

Better data on private companies

Value and customer

outcomes

Comprehensive private market data platform. Combining verified public-domain data with proprietary data enrichment. AI estimates revenue and EBITDA to fill any gaps.

Clients typically save ~30% vs. Pitchbook. Higher NPS (>70 and rising), retention (126%), and revenue growth (65%)

Primarily relies on manual data collection processes. Its strength lies in its extensive, historically rich database, though coverage can vary, particularly in international and mid-market segments and attribution of sources are generally not in the platform.

Higher costs, lower NPS (43 and in decline), slower growth (<10%), and lower retention (107%) per Morningstar SEC filings

Unparalleled sector research

Human-led analysis in a typical "DD" style. Layered CEO insights, rumoured deals and bottom-up company, market and investor analysis on a segmented market.

Offers analyst-led research, primarily delivered through static, PDF-based reports.

Unique interconnected data

Entire private market ecosystem: companies, investors, advisors, lenders, transactions, conferences, and people data, seamlessly linked in one platform, to provide a holistic

view.

Fragmented data with weak linkages makes analysis slow and less efficient. Acquired private credit database LCD and has been integrating this into Pitchbook.

Superior investor profiles

Clear, structured profiles showing the full context of funds, strategies, deals, and networks, making comparison and navigation easy.

Offers Investor profiles containing information on funds, specific deal histories, and key professional networks. Harder to navigate and lacks consistency. Limited ability to compare strategies or portfolios at scale.

#1 on international data

Leader in international data, surfacing SEC-like filings outside the US and local disclosures often overlooked by competitors. Especially strong in Europe and mid-market segments.

US-centric with stronger VC and funding round data. Weaker coverage outside of the US.

A source for everything

Every data point is sourced and auditable, ensuring full transparency and trust.

Supporting reliable decision making.

Less transparent sourcing and audit trails makes validation harder.

Intuitive, modern UX/UI

Fast, intuitive interface with interconnected

data and instant answers so teams can move fast with minimal training.

Complex interface with manual steps and fragmented workflows slow down teams and make adoption harder.

AI Native tools

Is built as an AI-native platform with features like natural language search, automated sourcing, two-way CRM synchronization, and off-the-shelf, standard bulk data services.

Offers a traditional SaaS feature set including 1-way CRM integration and, on request, bulk data services.

Value and customer

outcomes

Clients typically save ~30% vs. Pitchbook. Higher NPS (>70 and rising), retention (126%), and revenue growth (65%)

Higher costs, lower NPS (49 and in decline), slower growth (<10%), and lower retention (107%) per Morningstar SEC filings

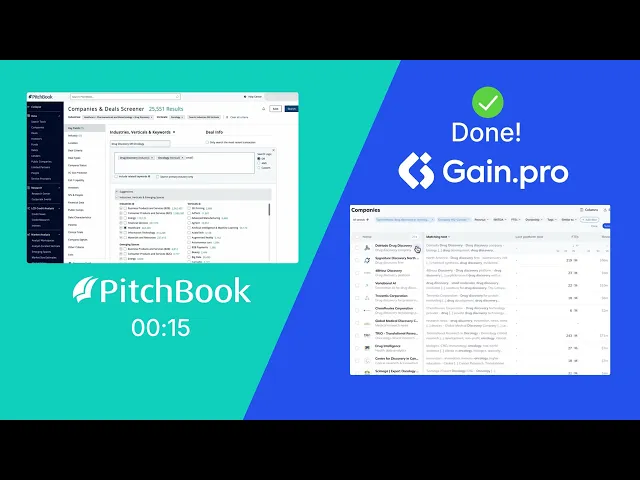

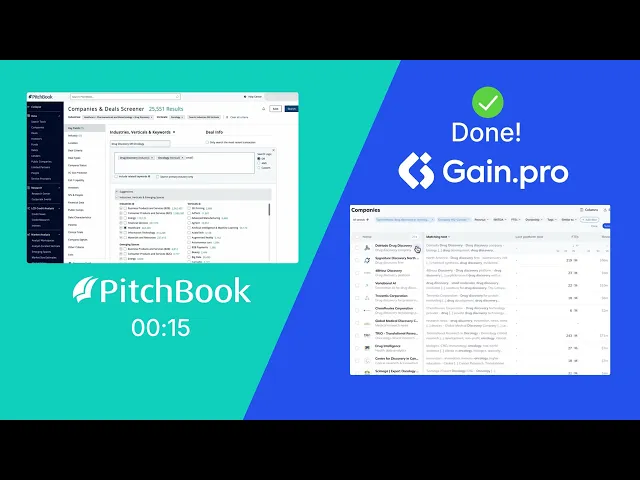

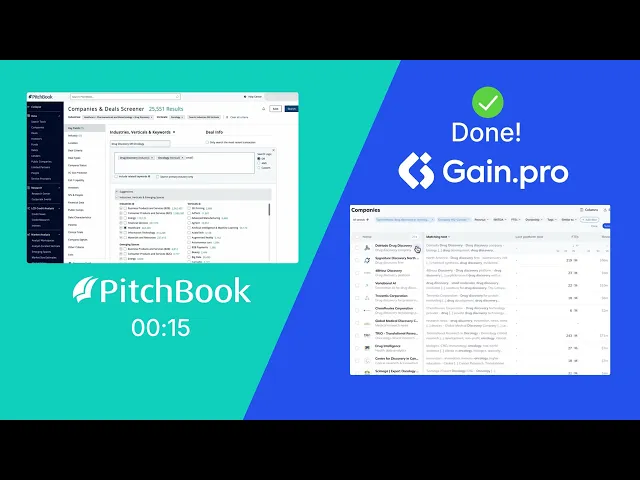

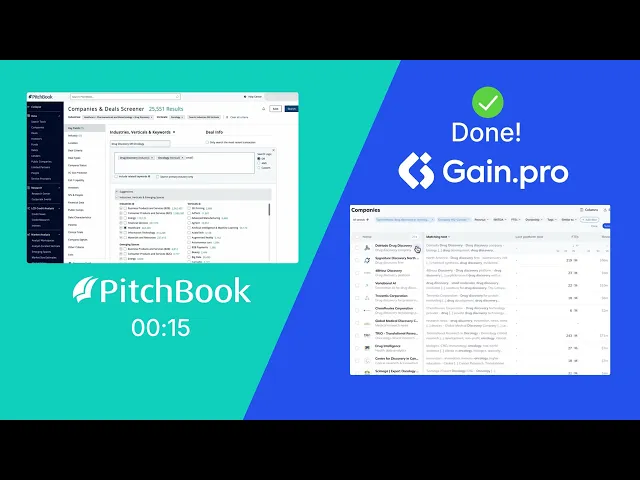

4x Faster

Company Search

Example search: “Find me drug discovery and niche life sciences targets in Canada”

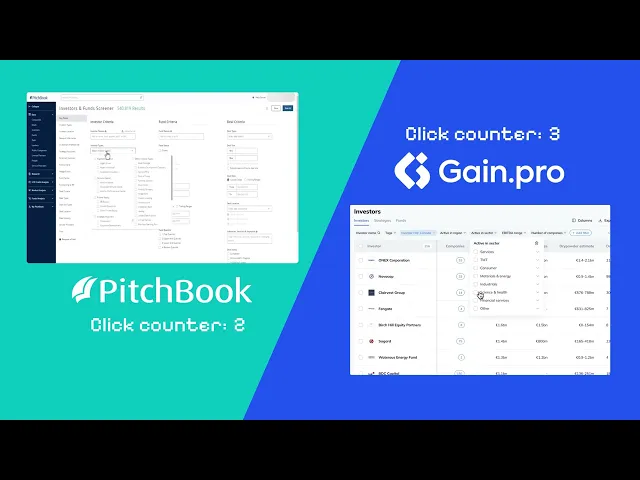

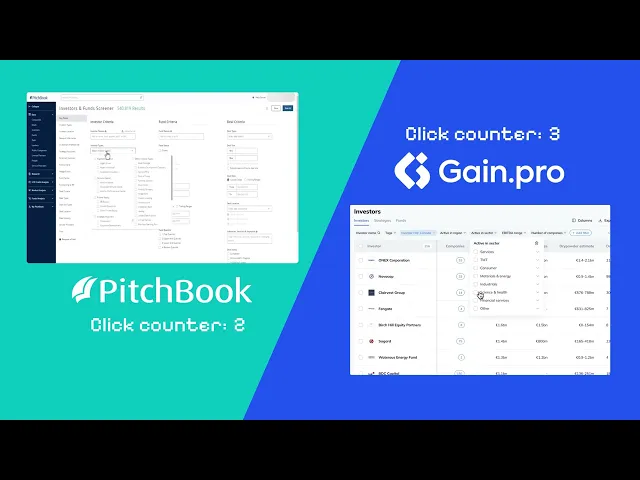

Investor Search in half the time

Example search: “Show me healthcare- focused buy-out funds”

4x Faster

Company Search

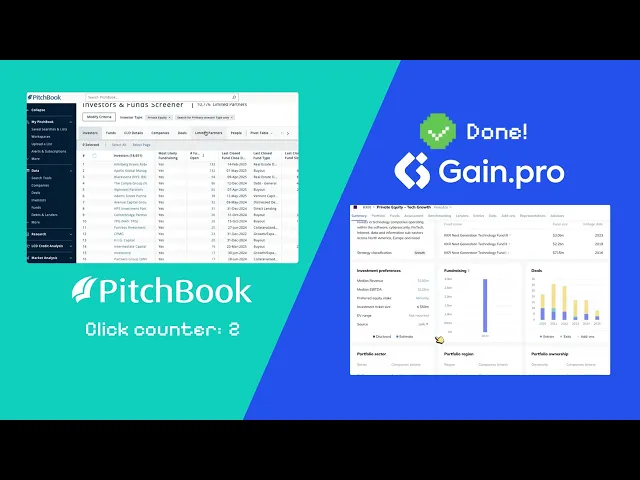

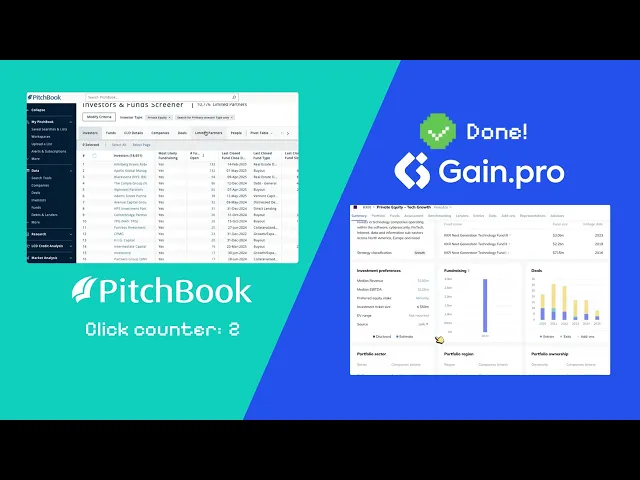

Investor Strategy Analysis Made Possible

Example search: “Find me drug discovery and niche life sciences targets in Canada”

Example search: “Show me which of KKR Growth’s assets are likely to come to market”

Investor Search in half the time

Investor Strategy Analysis Made Possible

Example search: “Show me healthcare- focused buy-out funds”

Example search: “Show me which of KKR Growth’s assets are likely to come to market”

Investor Strategy Analysis Made Possible

Example search: “Show me which of KKR Growth’s assets are likely to come to market”

The market isn’t waiting. Why should you?

The market isn’t waiting. Why should you?

The market isn’t waiting. Why should you?

“This was the first time I had encountered a solution that felt like it could improve the way we work, enhance efficiency and digitize our operations, all at the same time."

Wouter Giard

Director Corporate Finance - M&A

"Amazing product with extensive amount of data"

Verified User in Investment Banking

FTE's: 51-1000

"Gain.pro: A Premier Platform for Private Market Intelligence"

Verified User in Research

FTE's: 1000 or above

“We can’t deny that Gain.pro has enabled us to do more in the same amount of time and to focus more on activities where we can deliver a differentiating, added value to our clients.”

Arne Ballyn

Investment Banking Associate

"Easy to use with great insight"

Verified User in Consumer Services

FTE's: 50 or less

"Great time saver"

Verified User in Investment Banking

FTE's: 1000 or above

"With Gain.pro, our deal sourcing process has become more efficient. Instead of focusing on individual targets, we are now able to screen an entire sector in a swift manner."

Kevin Charymski

Investment Manager

"Great tool to support our sourcing efforts"

Hayo v.

FTE's: 50 or less

“Gain.pro increases my confidence that the accuracy of the answers we derive from our analysis is relatively high.”

Benjy Mason

Origination Analyst

"Great and efficient tool that saves a lot of time searching"

Verified User in VC and PE

FTE's: 50 or less

"All-in-one platform covering many sectors data"

Verified User in Health and Wellness

FTE's: 1000 or above

"Best-in-class platform for market research"

Verified User in VC and PE

FTE's: 51-1000

"Scouting exercise made easy for investors"

Director - Healthcare Private Equity

FTE's: 51-1000

“This was the first time I had encountered a solution that felt like it could improve the way we work, enhance efficiency and digitize our operations, all at the same time."

Wouter Giard

Director Corporate Finance - M&A

"Amazing product with extensive amount of data"

Verified User in Investment Banking

FTE's: 51-1000

"Gain.pro: A Premier Platform for Private Market Intelligence"

Verified User in Research

FTE's: 1000 or above

“We can’t deny that Gain.pro has enabled us to do more in the same amount of time and to focus more on activities where we can deliver a differentiating, added value to our clients.”

Arne Ballyn

Investment Banking Associate

"Easy to use with great insight"

Verified User in Consumer Services

FTE's: 50 or less

"With Gain.pro, our deal sourcing process has become more efficient. Instead of focusing on individual targets, we are now able to screen an entire sector in a swift manner."

Kevin Charymski

Investment Manager

"Great time saver"

Verified User in Investment Banking

FTE's: 1000 or above

"All-in-one platform covering many sectors data"

Verified User in Health and Wellness

FTE's: 1000 or above

"Great tool to support our sourcing efforts"

Hayo v.

FTE's: 50 or less

“Gain.pro helps us access a broader set of potential targets and filter them using key KPIs. We can now build a long list and systematically analyze each company in greater depth.”

Martin Klotz

Associate Director

"Best-in-class platform for market research"

Verified User in VC and PE

FTE's: 51-1000

“Gain.pro increases my confidence that the accuracy of the answers we derive from our analysis is relatively high.”

Benjy Mason

Origination Analyst

"Great and efficient tool that saves a lot of time searching"

Verified User in VC and PE

FTE's: 50 or less

"Scouting exercise made easy for investors"

Director - Healthcare Private Equity

FTE's: 51-1000

You can't win tomorrow's deals with yesterday's tools.

Upgrade to Gain.pro today

You can't win tomorrow's deals with

yesterday's tools.

Upgrade to

Gain.pro today

You can't win tomorrow's deals with yesterday's tools.

Upgrade to

Gain.pro today

4x Faster

Company Search

Example search: “Find me drug discovery and niche life sciences targets in Canada”

Investor Search in half the time

Example search: “Show me healthcare- focused buy-out funds”

One platform to find, assess and act on every opportunity.

© 2025 Gain.pro, all rights reserved

Gain.pro is SOC 2 Type 2 Certified

One platform to find, assess and act on every opportunity.

© 2025 Gain.pro, all rights reserved

Gain.pro is SOC 2 Type 2 Certified

One platform to find, assess and act on every opportunity.

Resources

© 2025 Gain.pro, all rights reserved

Gain.pro is SOC 2 Type 2 Certified