The Europe

250

250

Ranking the most active investors in Europe | 2024 Edition

Ranking the most active investors in Europe | 2024 Edition

Ranking the most active investors in Europe | 2024 Edition

Introduction

Welcome to the second edition of our Europe 250 ranking report. In this report, we rank and analyze the largest and most active private equity (PE) investors in Europe.

We take a novel approach to our ranking, which is based on total managed enterprise value (EV) in Europe. Ranking by managed EV rather than funds raised enables us to focus on investors’ European portfolio, allowing us to delve deep into specific regions and sectors of investment. Furthermore, this approach helps us capture large investors who do not have traditional fundraising numbers and are often overlooked by other industry rankings.

Table of contents

Executive Summary

Here is a summary of our key findings:

CVC has emerged as the #1 investor in Europe, managing a total EV of approximately €70bn, followed by EQT (€61bn) and KKR (€60bn). Collectively, the top 250 investors manage an EV of €1.6tn.

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

The Europe 250 landscape is fairly concentrated at the upper end with the top 25 investors managing 46% of the Europe 250 EV and the top 50 managing 66% of the EV. Investors established in the 1990s or before manage 75% of the total EV.

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Leading the region 50 rankings are CVC (Nordics and CEE), Cinven (DACH and Iberia), TDR Capital (UK&I), F2i SGR (Italy), Ardian (France) and KKR (Benelux). UK & Ireland (UK&I) is the most international region, with 55% of EV in the region owned by North American and RoW investors.

Europe 250 Ranking

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

Dominant Investor HQs

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

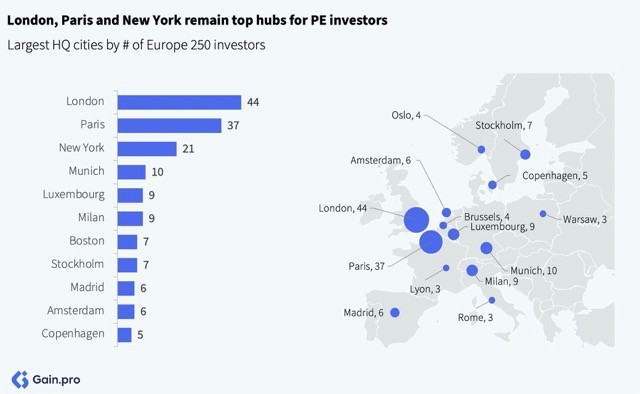

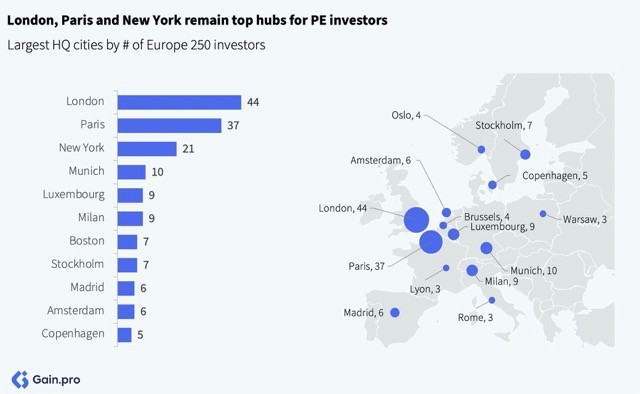

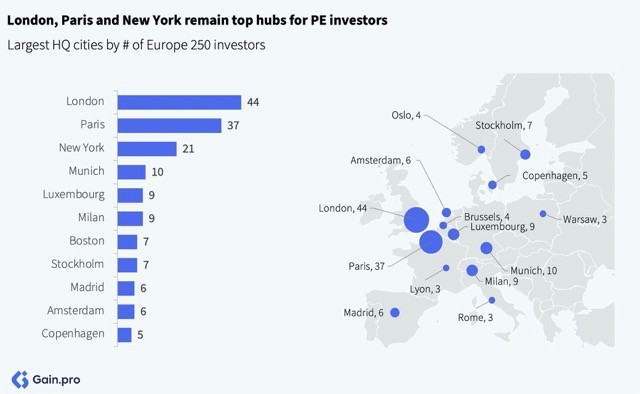

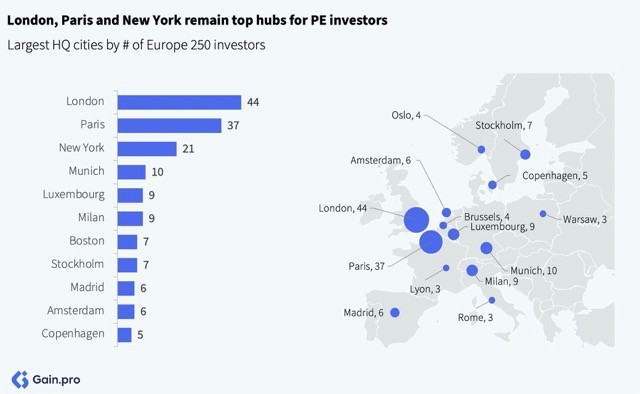

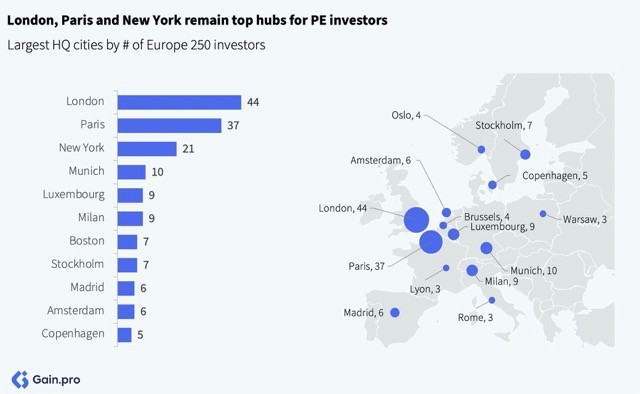

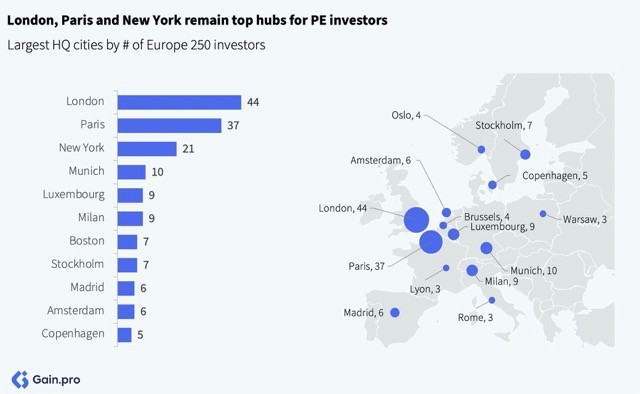

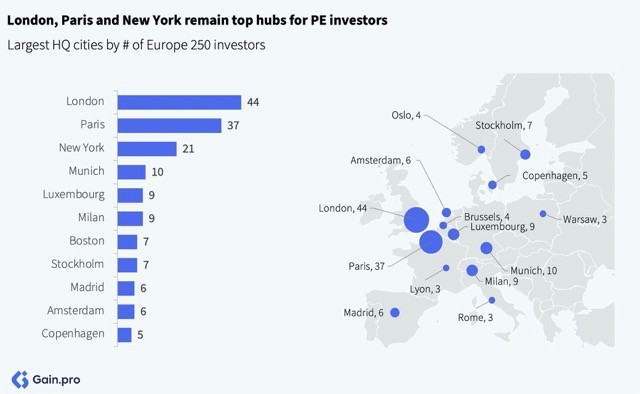

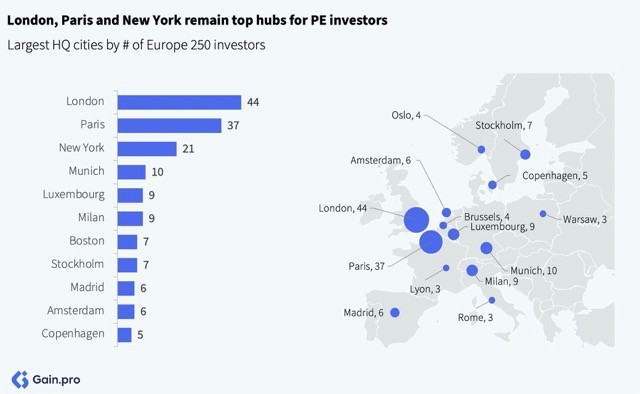

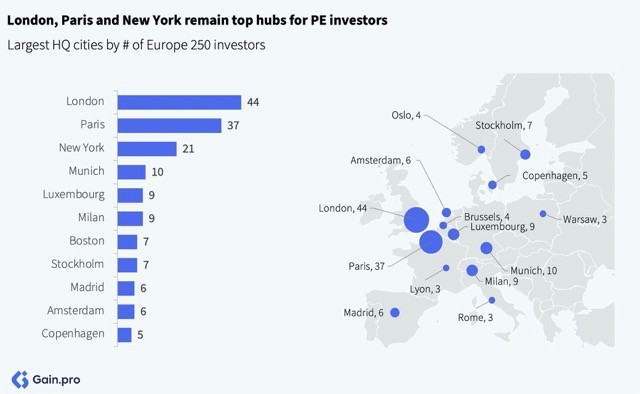

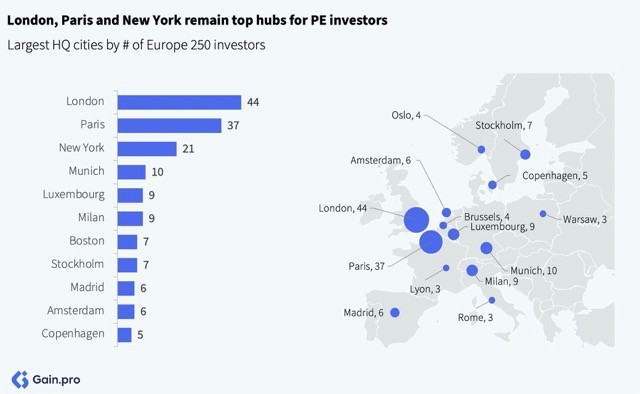

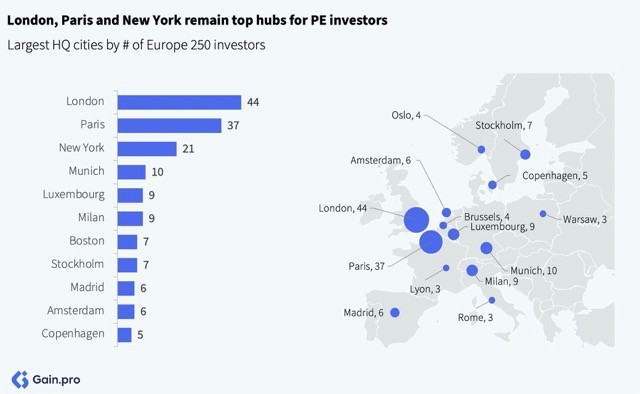

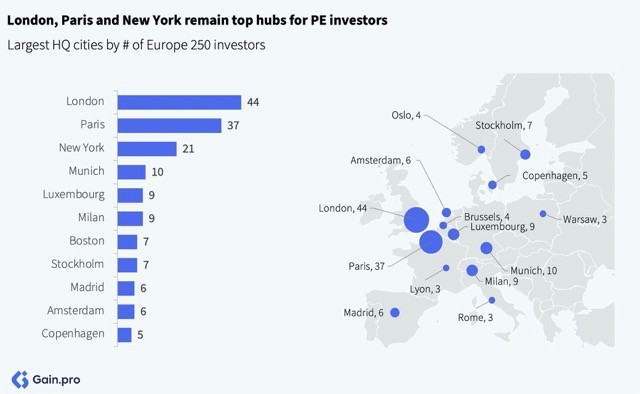

By city, London remains the main hub for Europe 250 investors, followed by Paris, New York and Munich. These 3 metropolises constitute ~40% of all HQs and are followed by the long tail of other large European and North American cities with a single-digit number of HQs.

Stockholm-based EQT Group, Amsterdam-headquartered Waterland and Baar-headquartered Partners Group stand out as notable firms within Europe 250 that are situated outside the US, UK or France.

Portfolio Differences: North American vs. European Investors

North American investors are larger in size compared to their European counterparts. They manage 33% of Europe 250 EV but hold only 21% of the spots. Moreover, their average portfolio EBITDA is 3x that of their European peers (€102m vs. €30m).

In comparison to their European counterparts, North American investors typically allocate a greater portion of assets to the UK and Italy. Conversely, they allocate fewer investments to the Nordics, Benelux and French regions, where there is stiff competition from regional European investors.

By sector, North American investors overweight TMT, Financials and Energy & Materials while being underweight in Services, Consumer and Science & Health. Specifically, the localized nature of the Services and Healthcare sectors, smaller company sizes, localized regulatory regimes and often (cross-border) M&A value creation stories make it somewhat harder for North American investors to execute many deals in this sector.

Investor Concentration

The Europe 250 landscape is fairly concentrated at the upper end with the top 25 investors managing 46% of the Europe 250 EV and the top 50 managing 66% of the EV. The top investors in Europe invest quite broadly across sectors and geographies, facilitated by offices in multiple cities.

Achieving greatness takes time, and this is evidenced by the distribution of managed EV based on investors' founding year. Investors established in the 1990s or before manage 75% of the total EV. All the top 10 investors in our Europe 250 ranking were also founded during or before the 1990s.

Executive Summary

Here is a summary of our key findings:

CVC has emerged as the #1 investor in Europe, managing a total EV of approximately €70bn, followed by EQT (€61bn) and KKR (€60bn). Collectively, the top 250 investors manage an EV of €1.6tn.

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Leading the region 50 rankings are CVC (Nordics and CEE), Cinven (DACH and Iberia), TDR Capital (UK&I), F2i SGR (Italy), Ardian (France) and KKR (Benelux). UK & Ireland (UK&I) is the most international region, with 55% of EV in the region owned by North American and RoW investors.

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Leading the region 50 rankings are CVC (Nordics and CEE), Cinven (DACH and Iberia), TDR Capital (UK&I), F2i SGR (Italy), Ardian (France) and KKR (Benelux). UK & Ireland (UK&I) is the most international region, with 55% of EV in the region owned by North American and RoW investors.

Europe 250 Ranking

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

Europe 250 Ranking

Uncover the full data set

Europe 250 Ranking

Uncover the full data set

Sector 50 Rankings

The following table presents the top 50 investors ranked within each sector in Europe. Use the buttons to switch between different sector rankings.

Leading the sector 50 rankings are the top Europe 250 investors — CVC (Services, Industrials and Financials), EQT (Science & Health) and KKR (Energy & Materials). Notable exceptions include Hg in TMT and TDR Capital in Consumer, whose investment strategies predominantly target these sectors, representing 72% and 63% of their assets, respectively.

Sector 50 Ranking

Uncover the full data set

Sector 50 Ranking

Uncover the full data set

Regional 50 Rankings

UK investors take the top spot in 5 regional rankings (UK&I, Nordics, Iberia, DACH and CEE) with CVC and Cinven bagging the #1 spot twice. Regional sponsors lead in Italy (F2i SGR) and France (Ardian), while the Benelux region is dominated by American investors (KKR, Blackstone and Carlyle).

Below, you'll find a ranking of the top 50 investors in each European region. Use the buttons to switch between different regions.

Regional 50 Ranking

Uncover the full data set

Regional 50 Ranking

Uncover the full data set

Portfolio Insights

In this section, we explore the investment portfolios of the top 30 PE investors in Europe, analyzing key metrics such as growth rates, profitability, leverage, buy-and-build initiatives and the sector/regional makeup of their European investments.

Note: We exclude from this analysis any investors who have less than 5 data points for a particular metric.

In this section, we explore the investment portfolios of the top 30 PE investors in Europe, analyzing key metrics such as growth rates, profitability, leverage, buy-and-build initiatives and the sector/regional makeup of their European investments.

Note: We exclude from this analysis any investors who have less than 5 data points for a particular metric.

Sector Split

The portfolio for the top investors in Europe is quite diversified with no sector in particular accounting for more than 50% of their assets, except for 4 investors: TDR Capital (Consumer), Hg (TMT), Macquarie Asset Management (Energy & Materials) and PAI Partners (Consumer).

Regional Split

The UK&I stands out as the primary investment destination for top investors in Europe, closely followed by DACH and France. At the investor level, distinctive strategies start to emerge, with Ardian's focus on the French market, TDR Capital's specialization in the UK and Triton's emphasis on the Nordics and DACH regions.

Portfolio EBITDA

GIC, TDR Capital, Clayton, Dubilier & Rice and CPP Investments stand out for their exceptionally high average portfolio EBITDA figures. These substantial numbers might not only signify a preference for larger-ticket investments but also underscore the operational excellence of their portfolio companies.

Split of investor portfolio by sector

Uncover the full data set

Split of investor portfolio by sector

Uncover the full data set

Methodology

We take a novel approach to our ranking, which is based on total managed enterprise value (EV) in Europe. At Gain.pro, we track over 8,700 investor portfolios in detail. We calculate the total managed EV by multiplying the number of European portfolio companies by the average portfolio EBITDA and a predicted EBITDA multiple.

# of portfolio companies in Europe.

We only consider buyout and minority-owned assets. We exclude any VC investments and publicly listed securities. We also adjust for ownership share, assigning 75% ownership share for any majority investments and 25% share for minority investments.

Average EBITDA.

We only include companies with a positive EBITDA and cap the metric for any outliers.

Predicted EBITDA multiple.

We leverage the company's sector, size, growth rate, margin profile and cash generation to predict its EBITDA multiple.

Further, we exclude any inactive investors from the Europe 250 ranking with i) <5 portfolio companies in Europe; ii) <5 entries since 2018 and iii) <3 positive portfolio EBITDA values. For the sector and regional rankings, we exclude investors with i) <3 portfolio companies in that sector/region; ii) <3 entries in that sector/region since 2018 and iii) <2 positive portfolio EBITDA values.

If you have any questions about the methodology or notice something amiss, do not hesitate to reach out at sid.jain@gain.pro.

Introduction

Welcome to the second edition of our Europe 250 ranking report. In this report, we rank and analyze the largest and most active private equity (PE) investors in Europe.

We take a novel approach to our ranking, which is based on total managed enterprise value (EV) in Europe. Ranking by managed EV rather than funds raised enables us to focus on investors’ European portfolio, allowing us to delve deep into specific regions and sectors of investment. Furthermore, this approach helps us capture large investors who do not have traditional fundraising numbers and are often overlooked by other industry rankings.

Table of contents

Executive Summary

Here is a summary of our key findings:

CVC has emerged as the #1 investor in Europe, managing a total EV of approximately €70bn, followed by EQT (€61bn) and KKR (€60bn). Collectively, the top 250 investors manage an EV of €1.6tn.

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

The Europe 250 landscape is fairly concentrated at the upper end with the top 25 investors managing 46% of the Europe 250 EV and the top 50 managing 66% of the EV. Investors established in the 1990s or before manage 75% of the total EV.

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Leading the region 50 rankings are CVC (Nordics and CEE), Cinven (DACH and Iberia), TDR Capital (UK&I), F2i SGR (Italy), Ardian (France) and KKR (Benelux). UK & Ireland (UK&I) is the most international region, with 55% of EV in the region owned by North American and RoW investors.

Europe 250 Ranking

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

Dominant Investor HQs

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

By city, London remains the main hub for Europe 250 investors, followed by Paris, New York and Munich. These 3 metropolises constitute ~40% of all HQs and are followed by the long tail of other large European and North American cities with a single-digit number of HQs.

Stockholm-based EQT Group, Amsterdam-headquartered Waterland and Baar-headquartered Partners Group stand out as notable firms within Europe 250 that are situated outside the US, UK or France.

Portfolio Differences: North American vs. European Investors

North American investors are larger in size compared to their European counterparts. They manage 33% of Europe 250 EV but hold only 21% of the spots. Moreover, their average portfolio EBITDA is 3x that of their European peers (€102m vs. €30m).

In comparison to their European counterparts, North American investors typically allocate a greater portion of assets to the UK and Italy. Conversely, they allocate fewer investments to the Nordics, Benelux and French regions, where there is stiff competition from regional European investors.

By sector, North American investors overweight TMT, Financials and Energy & Materials while being underweight in Services, Consumer and Science & Health. Specifically, the localized nature of the Services and Healthcare sectors, smaller company sizes, localized regulatory regimes and often (cross-border) M&A value creation stories make it somewhat harder for North American investors to execute many deals in this sector.

Investor Concentration

The Europe 250 landscape is fairly concentrated at the upper end with the top 25 investors managing 46% of the Europe 250 EV and the top 50 managing 66% of the EV. The top investors in Europe invest quite broadly across sectors and geographies, facilitated by offices in multiple cities.

Achieving greatness takes time, and this is evidenced by the distribution of managed EV based on investors' founding year. Investors established in the 1990s or before manage 75% of the total EV. All the top 10 investors in our Europe 250 ranking were also founded during or before the 1990s.

Executive Summary

Here is a summary of our key findings:

CVC has emerged as the #1 investor in Europe, managing a total EV of approximately €70bn, followed by EQT (€61bn) and KKR (€60bn). Collectively, the top 250 investors manage an EV of €1.6tn.

American and British investors dominate the Europe 250 ranking, with sponsors headquartered in those regions managing an EV of €420bn (26% share) and €373bn (23%) respectively. German-based investors are underrepresented despite it being the foremost economy in Europe, managing an EV of €54bn (3%).

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Leading the region 50 rankings are CVC (Nordics and CEE), Cinven (DACH and Iberia), TDR Capital (UK&I), F2i SGR (Italy), Ardian (France) and KKR (Benelux). UK & Ireland (UK&I) is the most international region, with 55% of EV in the region owned by North American and RoW investors.

Leading the sector 50 rankings are CVC (Services, Industrials and Financials), EQT (Science & Health), KKR (Energy & Materials), Hg (TMT) and TDR Capital (Consumer). American and British investors switch between #1 and #2 positions across all sectors.

Europe 250 Ranking

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

CVC has emerged as the leading investor in Europe, managing a total EV of approximately €70bn, followed by EQT (managing an EV of €61bn) and KKR (€60bn). CVC, EQT and KKR also feature as the top fundraisers globally. Other investors in the top 10 include GIC (€43bn), Blackstone (€36bn), Cinven (€34bn), Carlyle (€32bn), Ardian (€30bn), Advent International (€30bn) and Bain Capital (€29bn).

Collectively, the top 250 investors in Europe manage an estimated EV of €1.6tn. On average, they have a portfolio EBITDA of €49m and manage 22 companies.

Over the last 6 years, Europe 250 investors have invested in twice as many new portfolio companies as they have exited. Specifically, there have been approximately 5,405 new investments and 2,676 exits among these sponsors.

The table below lists all the top 250 investors in Europe. Use the search bar or the arrows at the top to navigate through the ranking.

Europe 250 Ranking

Europe 250 Ranking

Uncover the full data set

Europe 250 Ranking

Uncover the full data set

Sector 50 Rankings

The following table presents the top 50 investors ranked within each sector in Europe. Use the buttons to switch between different sector rankings.

Leading the sector 50 rankings are the top Europe 250 investors — CVC (Services, Industrials and Financials), EQT (Science & Health) and KKR (Energy & Materials). Notable exceptions include Hg in TMT and TDR Capital in Consumer, whose investment strategies predominantly target these sectors, representing 72% and 63% of their assets, respectively.

The following table presents the top 50 investors ranked within each sector in Europe. Use the buttons to switch between different sector rankings.

Leading the sector 50 rankings are the top Europe 250 investors — CVC (Services, Industrials and Financials), EQT (Science & Health) and KKR (Energy & Materials). Notable exceptions include Hg in TMT and TDR Capital in Consumer, whose investment strategies predominantly target these sectors, representing 72% and 63% of their assets, respectively.

US investors are in the lead and make the biggest pie.

Sector 50 Ranking

Uncover the full data set

Sector 50 Ranking

Uncover the full data set

Regional 50 Rankings

UK investors take the top spot in 5 regional rankings (UK&I, Nordics, Iberia, DACH and CEE) with CVC and Cinven bagging the #1 spot twice. Regional sponsors lead in Italy (F2i SGR) and France (Ardian), while the Benelux region is dominated by American investors (KKR, Blackstone and Carlyle).

Below, you'll find a ranking of the top 50 investors in each European region. Use the buttons to switch between different regions.

Regional 50 Ranking

Uncover the full data set

Regional 50 Ranking

Uncover the full data set

Portfolio Insights

In this section, we explore the investment portfolios of the top 30 PE investors in Europe, analyzing key metrics such as growth rates, profitability, leverage, buy-and-build initiatives and the sector/regional makeup of their European investments.

Note: We exclude from this analysis any investors who have less than 5 data points for a particular metric.

In this section, we explore the investment portfolios of the top 30 PE investors in Europe, analyzing key metrics such as growth rates, profitability, leverage, buy-and-build initiatives and the sector/regional makeup of their European investments.

Note: We exclude from this analysis any investors who have less than 5 data points for a particular metric.

In this section, we explore the investment portfolios of the top 30 PE investors in Europe, analyzing key metrics such as growth rates, profitability, leverage, buy-and-build initiatives and the sector/regional makeup of their European investments.

Note: We exclude from this analysis any investors who have less than 5 data points for a particular metric.

Sector Split

The portfolio for the top investors in Europe is quite diversified with no sector in particular accounting for more than 50% of their assets, except for 4 investors: TDR Capital (Consumer), Hg (TMT), Macquarie Asset Management (Energy & Materials) and PAI Partners (Consumer).

Sector Split

The portfolio for the top investors in Europe is quite diversified with no sector in particular accounting for more than 50% of their assets, except for 4 investors: TDR Capital (Consumer), Hg (TMT), Macquarie Asset Management (Energy & Materials) and PAI Partners (Consumer).

Regional Split

The UK&I stands out as the primary investment destination for top investors in Europe, closely followed by DACH and France. At the investor level, distinctive strategies start to emerge, with Ardian's focus on the French market, TDR Capital's specialization in the UK and Triton's emphasis on the Nordics and DACH regions.

Portfolio EBITDA

GIC, TDR Capital, Clayton, Dubilier & Rice and CPP Investments stand out for their exceptionally high average portfolio EBITDA figures. These substantial numbers might not only signify a preference for larger-ticket investments but also underscore the operational excellence of their portfolio companies.

Split of investor portfolio by sector

Uncover the full data set

Split of investor portfolio by sector

Uncover the full data set

Methodology

We take a novel approach to our ranking, which is based on total managed enterprise value (EV) in Europe. At Gain.pro, we track over 8,700 investor portfolios in detail. We calculate the total managed EV by multiplying the number of European portfolio companies by the average portfolio EBITDA and a predicted EBITDA multiple.

# of portfolio companies in Europe.

We only consider buyout and minority-owned assets. We exclude any VC investments and publicly listed securities. We also adjust for ownership share, assigning 75% ownership share for any majority investments and 25% share for minority investments.

Average EBITDA.

We only include companies with a positive EBITDA and cap the metric for any outliers.

Predicted EBITDA multiple.

We leverage the company's sector, size, growth rate, margin profile and cash generation to predict its EBITDA multiple.

Further, we exclude any inactive investors from the Europe 250 ranking with i) <5 portfolio companies in Europe; ii) <5 entries since 2018 and iii) <3 positive portfolio EBITDA values. For the sector and regional rankings, we exclude investors with i) <3 portfolio companies in that sector/region; ii) <3 entries in that sector/region since 2018 and iii) <2 positive portfolio EBITDA values.

If you have any questions about the methodology or notice something amiss, do not hesitate to reach out at sid.jain@gain.pro.

Discover hundreds of niche industry reports on Gain.pro

Discover hundreds of niche industry reports on Gain.pro

Discover hundreds of niche industry reports on Gain.pro

Deep dive into additional industries to understand their market outlook, positive and negative drivers, and more!

Deep dive into additional industries to understand their market outlook, positive and negative drivers, and more!

Deep dive into additional industries to understand their market outlook, positive and negative drivers, and more!

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved