Financial metrics like revenue growth and profitability margins have always been the primary markers in assessing investment opportunities, but a recent, non-financial metric has quickly gained traction in becoming a significant factor in any investment strategy. This is the environment, social, and governance assessment, or ESG.

ESG criteria is a set of standards used by investors to screen and evaluate potential investments based on the environmental, social, and governmental impact on the company itself and society as a whole.

Environmental factors consider how a company safeguards the environment. This takes into account a company’s use of resources, its waste, and its impact on nearby communities.

Social factors dive into the ways a company manages relationships with employees, suppliers, customers, and the community where it operates.

The final criteria – governance – analyzes anything to do with the governance within the company. This includes its leadership, executive pay, audits, internal controls, and shareholder rights.

ESG’s Growing Relevance in Private Equity Strategies

Even though ESG doesn’t necessarily have anything to do with financial performance, it's become a hot topic in private equity with 42 percent of the largest fund managers saying they consider ESG issues either seriously or very seriously in their decision-making process (2022 Global Private Equity Survey). LPs have been raising the pressure on responsible investing, requiring investors to now include social and environmental factors in their multi-strategy approach.

According to the 2020 Edelman Trust Barometer Special Report: Institutional Investors, 88 percent of LPs globally use ESG performance indicators in making investment decisions, and 87 percent said they invest in companies that have reduced their near-term return on capital so they can reallocate that money to ESG initiatives. For general partners, this means that ESG is becoming a crucial factor in raising money.

To further emphasize the growing popularity of ESG metrics, we’ve recently seen the emergence of impact funds that are dedicated to investing in sustainable companies that can create positive environmental and social outcomes, as well as financial gains. For these funds, ESG is one of the main criteria when assessing potential investments.

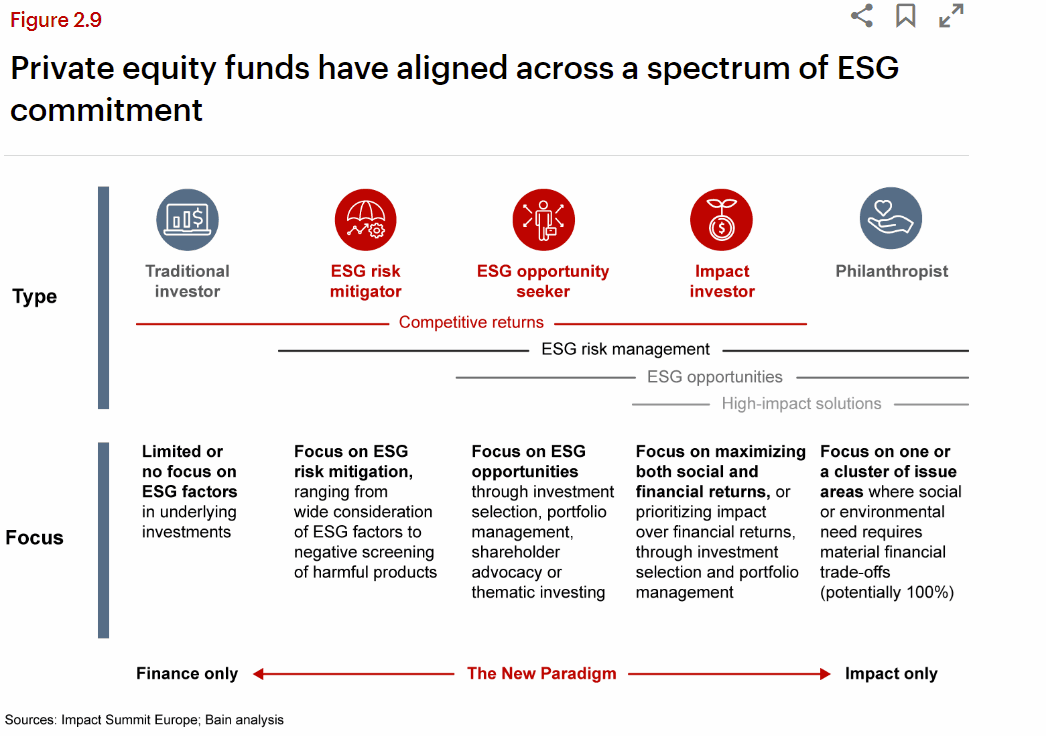

How PE investors are incorporating ESG into their investment strategies is highly variable, but they are all aligning themselves along a spectrum of ESG commitments. This spectrum spans from traditional investors with limited ESG focus to impact investors with a strong focus on maximizing both social and financial returns.

Source: Investing with Impact: Today’s ESG Mandate - Private Equity | Bain & Company

Impact Beyond Environment, Social, and Governance

Although investing in sustainable companies has its obvious benefits in safeguarding the environment and society, this is not its only advantage.

First and foremost, ESG-friendly investments can help investors reduce long-term risks and avoid investment losses when companies or industries engage in risky or unethical practices. These practices could include human rights issues or severe environmental implications that could be sanctioned by local governments in due time.

ESG-aware companies also tend to have reduced overhead costs as they minimize their environmental impact by decreasing water and resource usage.

As social and environmental awareness has become a major topic in communities across the globe, sustainability and ethical branding increasingly affect consumer behavior and business conditions. As such, there’s growing evidence that ESG programs can actually improve investment returns.

You can see this by reviewing the performance of the ESG leaders and their public counterparts in the STOXX Global 1800 Index. Over a 16 year span, the top ESG companies outperformed their peers by 37 percent. (Investing with Impact: Today’s ESG Mandate - Private Equity | Bain & Company)

To further this point, a 2018 Nielsen study focusing on the sales of chocolate, coffee, and bath products in the United States reports that sales for companies that had environmentally-conscious branding grew four times faster than competitor sales.

Environmentally-friendly branding can go a long way when maximizing company returns. When KKR bought Unilever’s spreads business (now called Upfield) in 2018, they replaced their source for palm oil with one that is 100% sustainable, significantly minimizing their CO2 footprint. The company increased in value by reducing a prominent ESG risk from their business and aligning with consumer trends. (Investing with Impact: Today’s ESG Mandate - Private Equity | Bain & Company)

While studies show positive benefits to ESG investing, the ultimate value of ESG will depend on whether it actually encourages companies to drive real change for the common good, or if it’s merely there to check boxes and publish attractive reports for LPs. No matter, implementing ESG-friendly policies brings companies one step closer to ethical business models that drive change within the company and the community as a whole.

Building a Future-Proof ESG Strategy

Even though PE funds are still designed to achieve the same goal as always – generate positive returns – what’s evident is that every PE firm needs to consider ESG criteria within their investment strategy to stay ahead of their peers and generate maximum returns on their investments.

But like most investment strategies, there is no plug-and-play ESG strategy. Every investor has to develop their own approach based on a unique blend of culture, strategy, and stakeholder preferences, then gain visibility on these ESG assessments.

As opposed to listed companies, private market companies are less subject to disclose non-financial information. This on its own makes it difficult to properly evaluate ESG risk profiles, but what makes it even more difficult is that there is still no comprehensive way to measure ESG risks. So, reporting on this matter can sometimes be idiosyncratic.

To help create a standardized view on ESG assessments within the private market, Gain.pro developed a framework that evaluates key environmental and social risks for specific sub-industries and the companies that fall within them. Every industry receives an ESG rating based on the overall risk exposure. To complement this, ESG industry assessments present comprehensive reports on the key risks and opportunities within the industry.

In order to gain unique insight into ESG profiles, Gain.pro conducts C-level interviews with influential professionals within their industries. These perspectives come straight from the boardroom and provide you with invaluable details on the status of the industries that interest you most.

In addition to this, Gain.pro looks at every company individually to assess whether they are proactively and successfully addressing company-specific or industry-specific risks. If so, Gain.pro classifies them as ESG outperformers.

By using Gain.pro, investors can develop a view on the ESG risks of an industry or a private company within minutes. They can then compare companies within the same industry based on a standardized ESG rating scale. This feature helps PE investors make well informed decisions based on their investment strategy.

The Outlook for ESG Performance Metrics

Evidence shows that companies can actually do well by doing good, however private equity investors have the unique mandate to produce substantial returns on a tight timeline. At the end of the day, if doing good means compromising returns, these efforts will more than likely fizzle out. So, we’re left wondering if they’re here to stay.

At Gain.pro, we wouldn’t bet on them leaving any more than we would bet against the historic increase of global concern around climate change and corporate responsibility.

Although the private equity industry has historically viewed ESG as a sideshow – something good to do in addition to a fund’s normal business of buying and selling companies – what we’ve learned is that ESG is not just about doing good for good’s sake, but about recognizing what your customers truly want and turning that into a strategy that creates tangible value.

This value goes beyond financial returns as companies that set an agenda for ESG-friendly growth will likely be seen as more attractive investment opportunities by investors as they are less risky, better positioned for the long-term, and better prepared for uncertainty.

Since the significance of ESG doesn’t seem to be dwindling anytime soon, it’s more important than ever for investors to have full visibility on the companies that matter to them most. That’s where Gain.pro fits in. To learn more about how Gain.pro can save you hours of work by providing full reports on private market insight, schedule a demo today!