Growth is a key investment criteria for most investors out there. Resilience, defined as through-the-cycle performance, is also on the top of the industry's list. But what about resilience to pandemics or sudden global supply chain shocks? We are pretty sure this was not a key consideration for many investors until 2020...

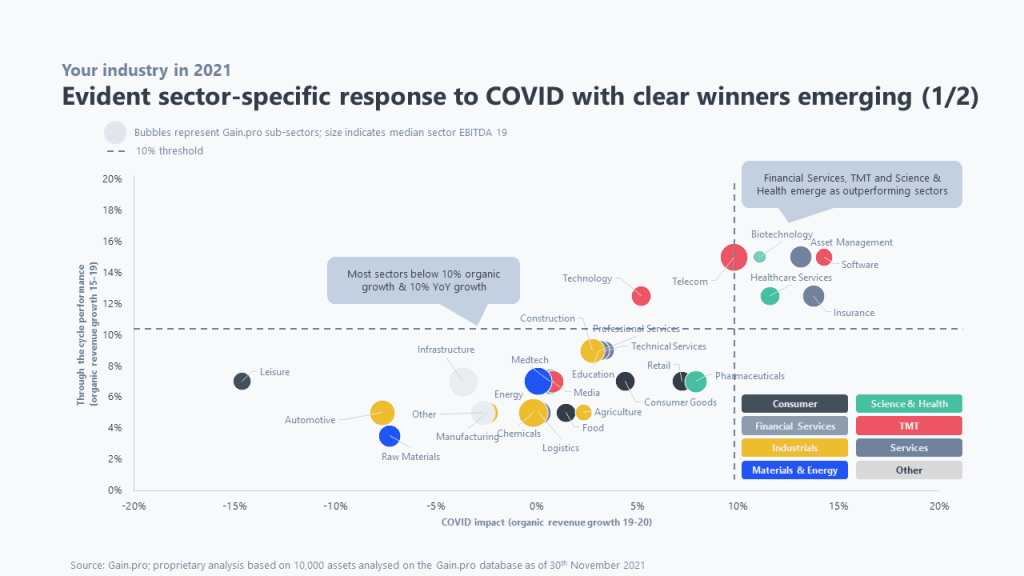

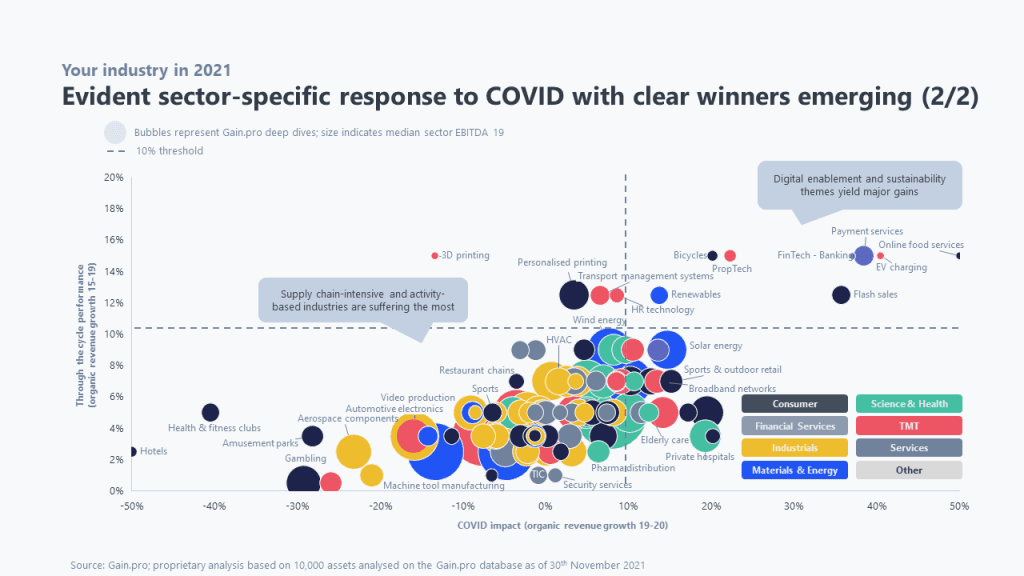

In our proprietary analysis covering >10,000 assets we have analysed exactly this. We have mapped the longer-term resilience vs. the COVID-induced 1 year (shock) effect for assets belonging to different sub-sectors as well as Gain.pro's proprietary industry deep-dives.

What we can see from the analysis is that most segments have had a moderate negative impact due to e.g. closed sites (technical services) or shortage in components (Medtech) and that a smaller group of segments have performed in line with long-term performance (Pharmaceuticals). However, on the extreme end we can see two groups with a very significant impact form pandemic effects, e.g. a negative impact in Leisure of c. -20% and a growth acceleration of c. +20% in flash sales and payment services.

We expect the same trends to continue throughout the first half of 2022 and only a gradual recovery for the heavily impacted segments with a return to "normal" in the second half of the year. However, some segments are changed for good and players might have to adjust their business models to remain relevant.

Do not forget to also check-out our interactive Tableau dashboard accessible through this link. The Tableau dashboard is based on sector deep-dives on the Gain.pro platform. If you are interested in receiving one of these reports, do not hesitate to reach out!

Contact us at info@gain.pro to learn more