2021 was a record year for the European private equity industry on many fronts. European PEs raised c. €90bn and invested almost €800bn in >7,000 deals. High levels of dry powder in combination with strong debt markets have led to crowded auctions and inflated valuation levels, especially for outperforming and resilient businesses. An important industry trend is an increased focus on value creation initiatives in an attempt to minimize the overall COVID impact on returns. Most notably, we have seen a record volume off add-ons acquisitions by PE portfolio companies. We have analysed our proprietary data set of European PE platform deals to see if we can distinguish some further trends.

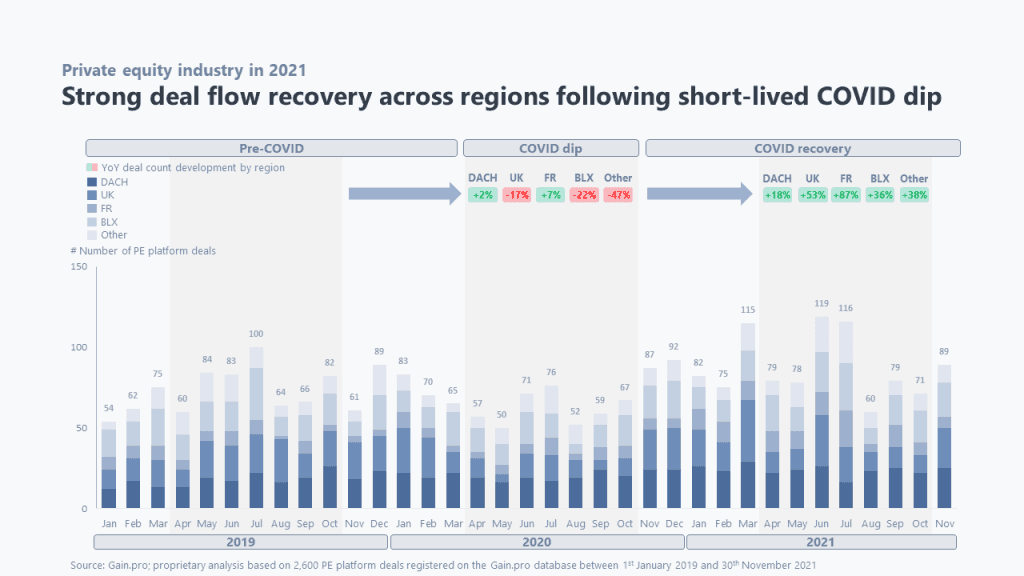

With Brexit and the pandemic, the UK has seen a double effect reducing overall dealflow in 2020. Last year the region has shown very strong recovery (+53%) with a large volume of mega deals as well as take-private transactions. France has seen the biggest relative increase in dealflow (+87%) driven by growth in the mid-market segment and strong interest in deals in resilient sectors such as software, education and healthcare. The DACH (+18%) and Benelux (+36%) regions have seen healthy but slightly lower growth with similar drivers as the other key European PE markets: record levels of dry powder in combination with a rush from investors to acquire rush from investors to acquire resilient businesses.

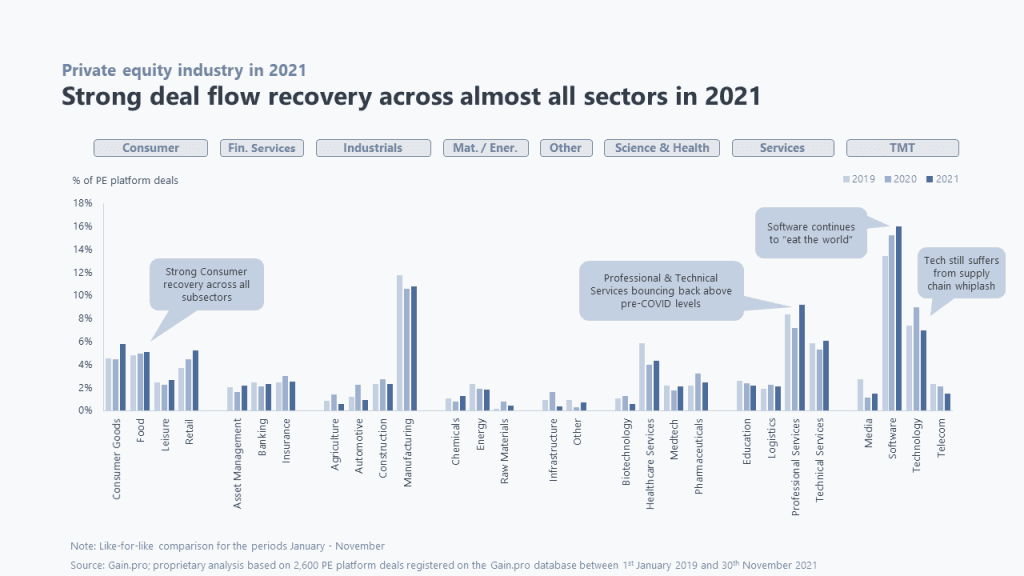

When zooming in on the sectors, we can see that most segments have shown recovery vs. 2020. Exception to this are technology and industrial segments where the global component shortage might have impacted short-term financial performance which might have in turn impacted transaction timelines.

Another takeaway from our analysis is the continued strong interest for software businesses, which we believe, has been further fueled by the pandemic. The pandemic has stressed the importance of portfolio composition and resilience to investors. The strong financial performance during COVID and the high level of recurring revenue has put the sector even more in the spotlight with investors - and offered an ideal exit window for sellers.

Contact us at info@gain.pro to learn more