Why it is a crucial part to becoming a top performing PE.

Every good investment professional loves to analyze markets.

How big is it? How fast is it growing? What market share can my target achieve?

That’s why it’s so surprising that many PE firms we talk to struggle with answering that basic question for themselves. How many companies are there for me to invest in? Hundreds? Thousands? Millions? Often, PE firms don’t even have a view on the ballpark figure, let alone know the exact number.

We strongly believe that every investment professional should know the number of companies that fall within their firm's sweet spot. Why? Because it drives how you operate as a firm, how you structure your origination process, your data gathering methods, your human processes and even the digital tooling around it.

You would expect no less from the sales team of a portfolio company, so it's time to apply the same standards of excellence to the 'sales' process in PE: identifying potential deals that are eligible for capital deployment within your investment parameters.

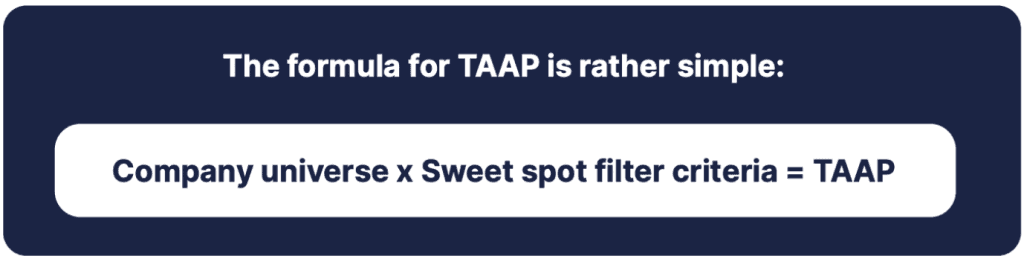

We coin it the Total Addressable Asset Pool, or TAAP.

By knowing your TAAP, you can turn your firm’s distinct sweet spot into a well-designed process that sources quality leads out of the millions of companies in the world.

What is your Company Universe?

How many companies are there in the world? Or in your relevant geography? The question is simple, but the answer is rather hard to find.

Our Co-Founder, Frister Haveman, has written a full eGuide to give you an easy methodology on how you can clearly identify your sweet spot and ensure you can gain full visibility of potential opportunities.