Customer story

Streamlined Sourcing

How

Comitis Capital

Optimizes their

Deal Origination Workflow

How

Comitis Capital

Optimizes their

Deal Origination Workflow

Founded in 2021, Comitis Capital is a purpose-driven private equity firm headquartered in Frankfurt, Germany with an investment focus on Western Europe. They specialize in majority partnerships with founders and management teams, but also have flexibility to take (significant) minority positions, with a sweet spot of €30-50 million equity per investment.

Comitis Capital takes a customized approach to each partnership that aims to accelerate profitable revenue growth and create impactful businesses. By offering entrepreneurs and business leaders strategic guidance, organizational excellence and access to a broad network of experts, they drive long-term value creation for all their portfolio companies.

The Need for a Digital Solution

The Need for a Digital Solution

The Need for a Digital Solution

With a very lean setup, Comitis Capital recognized the need to be as efficient and effective as possible in their workflows to keep pace with their larger peers. To do so, they turned to technology.

With a very lean setup, Comitis Capital recognized the need to be as efficient and effective as possible in their workflows to keep pace with their larger peers. To do so, they turned to technology.

“Technology is absolutely crucial for us, especially because we’re a small team and don’t have the same resources as our peers who employ large classes of associates and analysts. So, for us, technology is foundational in driving the efficiency and effectiveness of our small team.”

Felix Jauch

“Technology is absolutely crucial for us, especially because we’re a small team and don’t have the same resources as our peers who employ large classes of associates and analysts. So, for us, technology is foundational in driving the efficiency and effectiveness of our small team.”

Felix Jauch

“Technology is absolutely crucial for us, especially because we’re a small team and don’t have the same resources as our peers who employ large classes of associates and analysts. So, for us, technology is foundational in driving the efficiency and effectiveness of our small team.”

Felix Jauch

When building their tech stack, they sought out a digital solution that would streamline their proprietary deal sourcing workflow, helping them to quickly identify, analyze and engage with relevant companies.

''Having a tool that helps us easily identify and review relevant companies is critical for us. It’s the core of our origination and proprietary sourcing approach—finding the right companies, reviewing their performance, identifying key decision-makers and then reaching out to them.''

Felix Jauch

Investment Associate

''Having a tool that helps us easily identify and review relevant companies is critical for us. It’s the core of our origination and proprietary sourcing approach—finding the right companies, reviewing their performance, identifying key decision-makers and then reaching out to them.''

Felix Jauch

Investment Associate

''Having a tool that helps us easily identify and review relevant companies is critical for us. It’s the core of our origination and proprietary sourcing approach—finding the right companies, reviewing their performance, identifying key decision-makers and then reaching out to them.''

Felix Jauch

Investment Associate

While Comitis Capital used other data platforms, they found the data lacking in quality and the platforms themselves difficult and slow to navigate, meaning their deal sourcing process still required a significant amount of time and manual work.

While Comitis Capital used other data platforms, they found the data lacking in quality and the platforms themselves difficult and slow to navigate, meaning their deal sourcing process still required a significant amount of time and manual work.

While Comitis Capital used other data platforms, they found the data lacking in quality and the platforms themselves difficult and slow to navigate, meaning their deal sourcing process still required a significant amount of time and manual work.

“Other platforms use legacy dashboards, and the filtering capabilities are slow and not very intuitive. Oftentimes, the information—especially regarding sectors—isn’t accurate. That’s why we started looking for an alternative solution.”

Felix Jauch

“Other platforms use legacy dashboards, and the filtering capabilities are slow and not very intuitive. Oftentimes, the information—especially regarding sectors—isn’t accurate. That’s why we started looking for an alternative solution.”

Felix Jauch

“Other platforms use legacy dashboards, and the filtering capabilities are slow and not very intuitive. Oftentimes, the information—especially regarding sectors—isn’t accurate. That’s why we started looking for an alternative solution.”

Felix Jauch

Choosing Gain.pro as their Private Market Intelligence Platform

Choosing Gain.pro as their Private Market Intelligence Platform

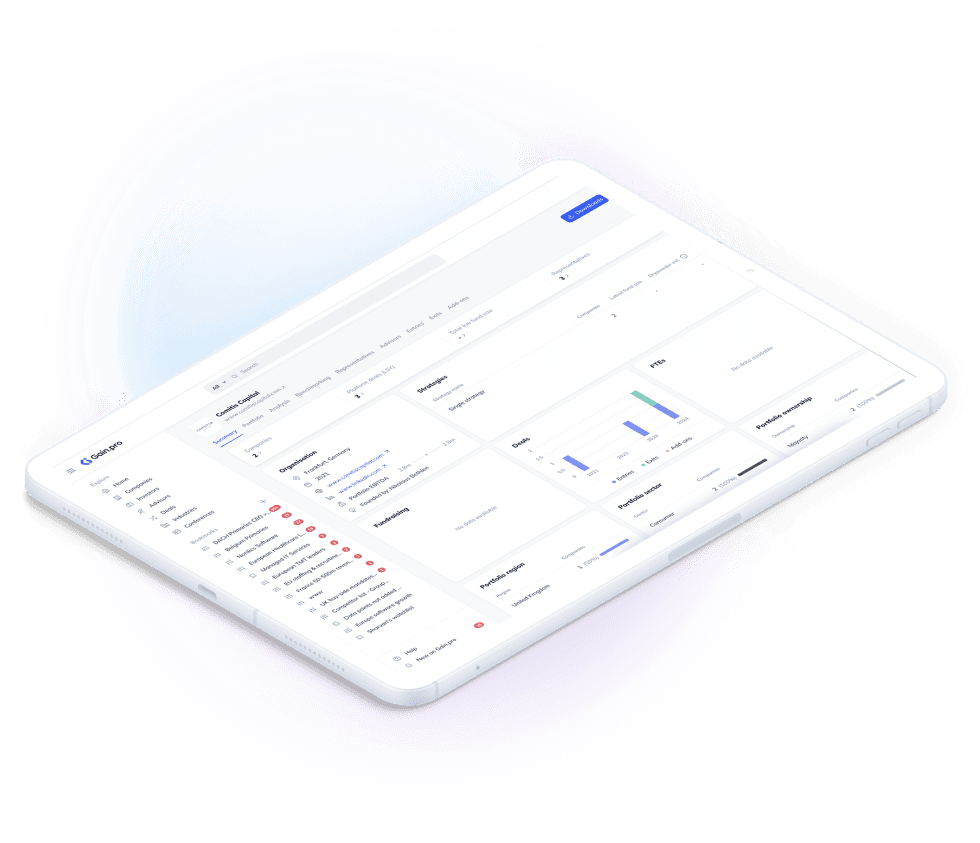

After evaluating other platforms, Comitis Capital decided on Gain.pro as their go-to private market intelligence platform. What stood out to them the most was its ease of use and superior data quality. They were also impressed by its advanced functionalities that would allow them to quickly identify investment opportunities in niche sectors.

After evaluating other platforms, Comitis Capital decided on Gain.pro as their go-to private market intelligence platform. What stood out to them the most was its ease of use and superior data quality. They were also impressed by its advanced functionalities that would allow them to quickly identify investment opportunities in niche sectors.

After evaluating other platforms, Comitis Capital decided on Gain.pro as their go-to private market intelligence platform. What stood out to them the most was its ease of use and superior data quality. They were also impressed by its advanced functionalities that would allow them to quickly identify investment opportunities in niche sectors.

"We explored Gain.pro, along with other tools in the market. However, Gain.pro really excelled with its search and tags functionality as well as Similar Company feature. It allows us to quickly and easily get a solid understanding of relevant players in a sector, even if it’s a niche one. ''

Felix Jauch

"We explored Gain.pro, along with other tools in the market. However, Gain.pro really excelled with its search and tags functionality as well as Similar Company feature. It allows us to quickly and easily get a solid understanding of relevant players in a sector, even if it’s a niche one. ''

Felix Jauch

"We explored Gain.pro, along with other tools in the market. However, Gain.pro really excelled with its search and tags functionality as well as Similar Company feature. It allows us to quickly and easily get a solid understanding of relevant players in a sector, even if it’s a niche one. ''

Felix Jauch

Use Cases:

Proprietary Deal Sourcing on Gain.pro

Proprietary Deal Sourcing on Gain.pro

Proprietary Deal Sourcing on Gain.pro

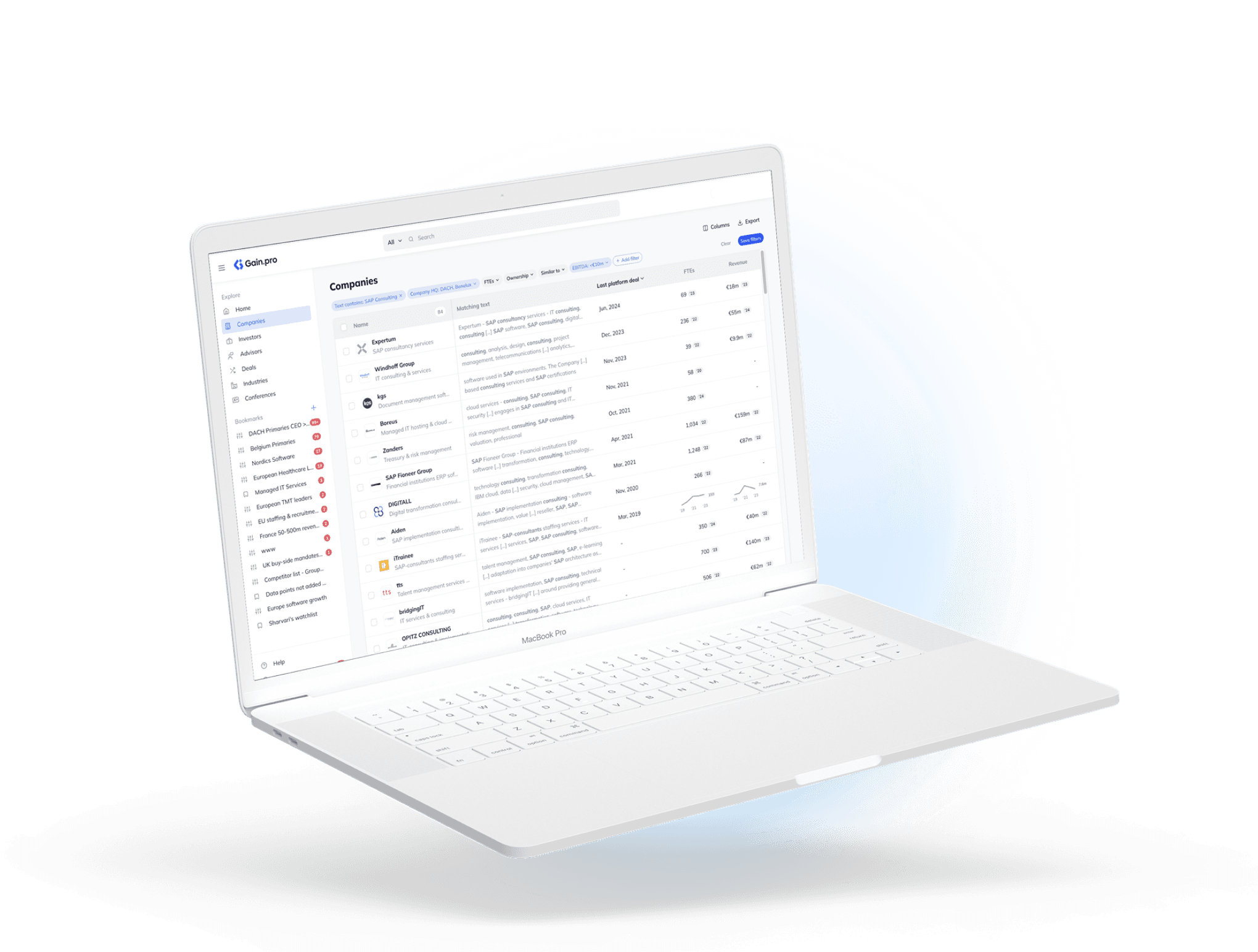

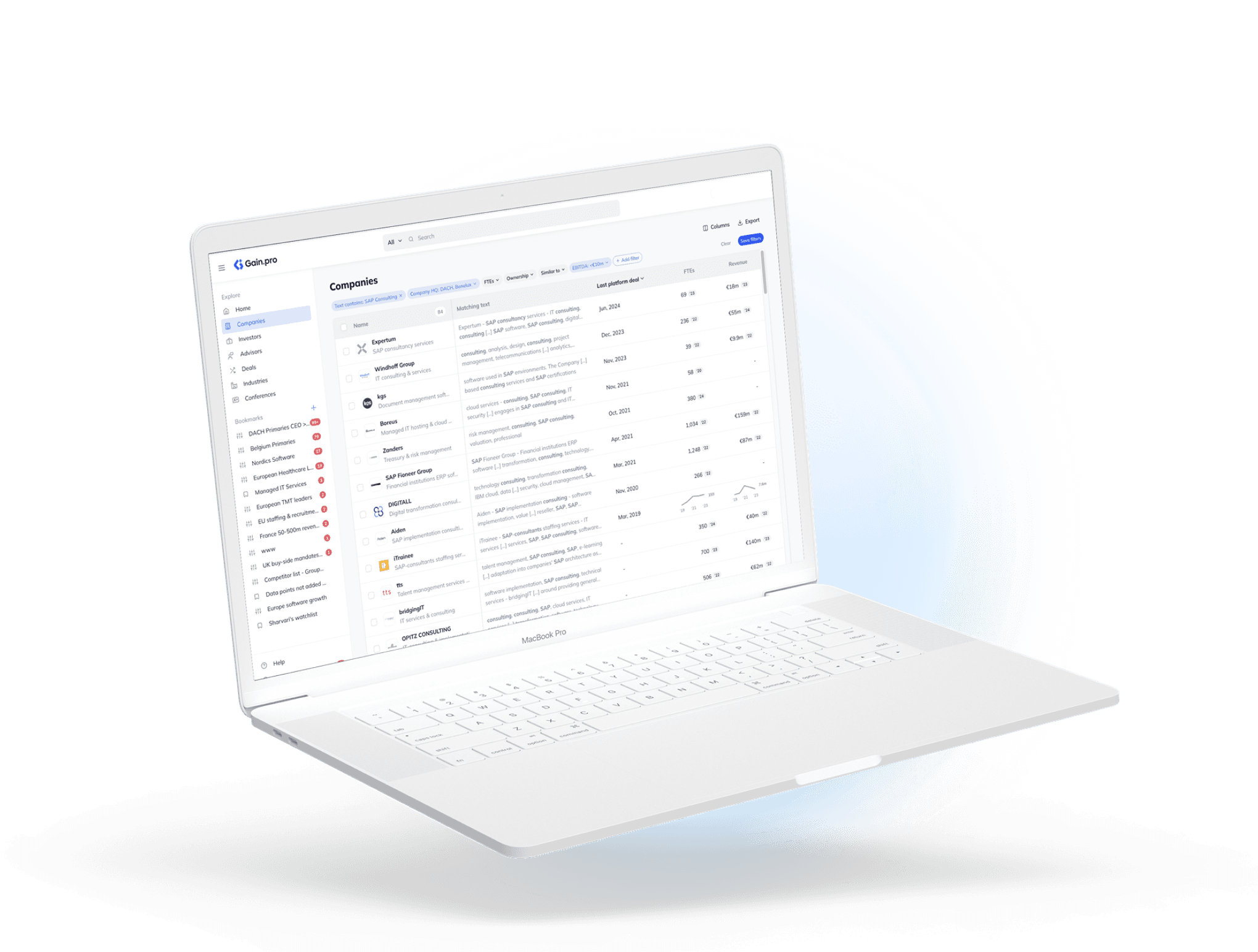

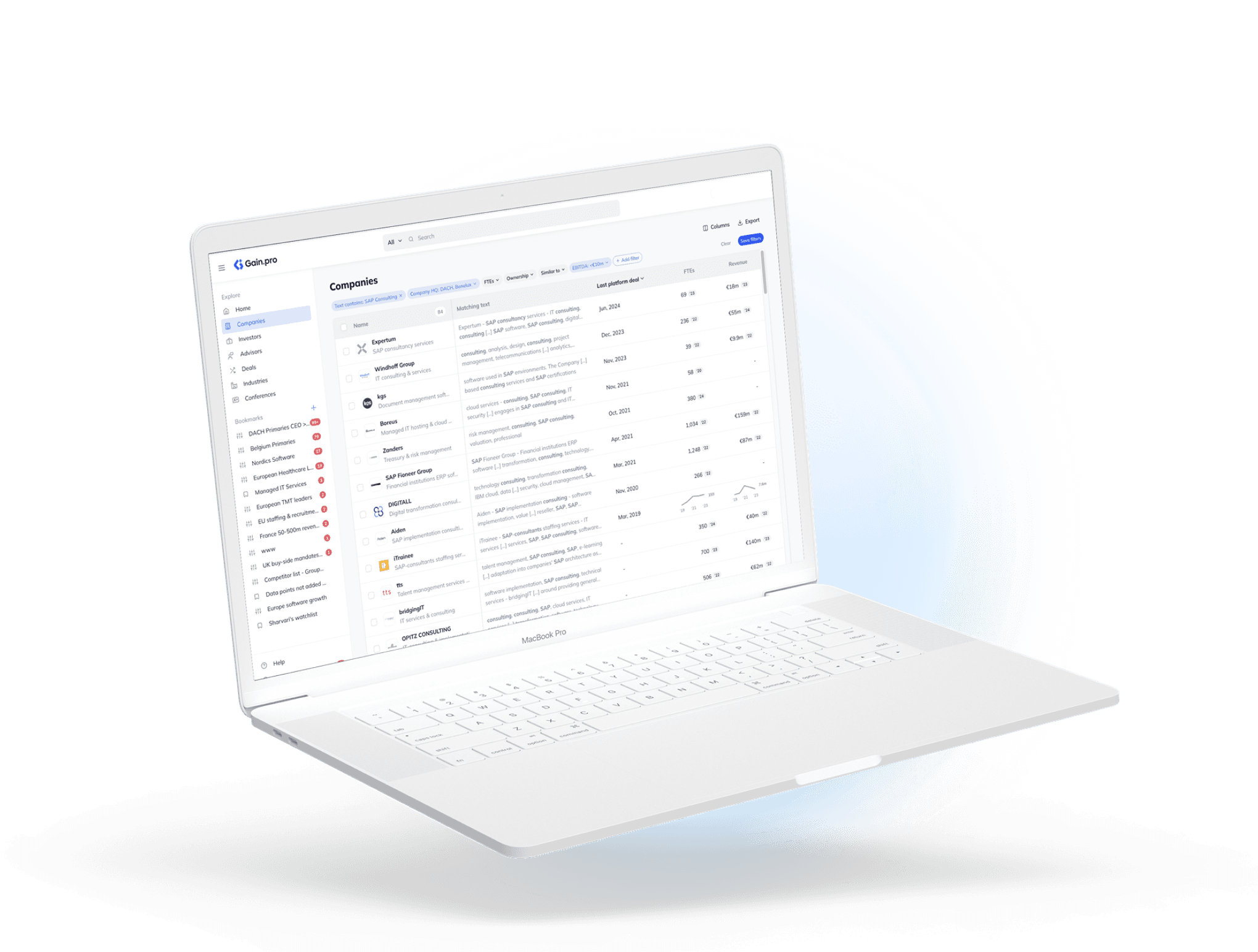

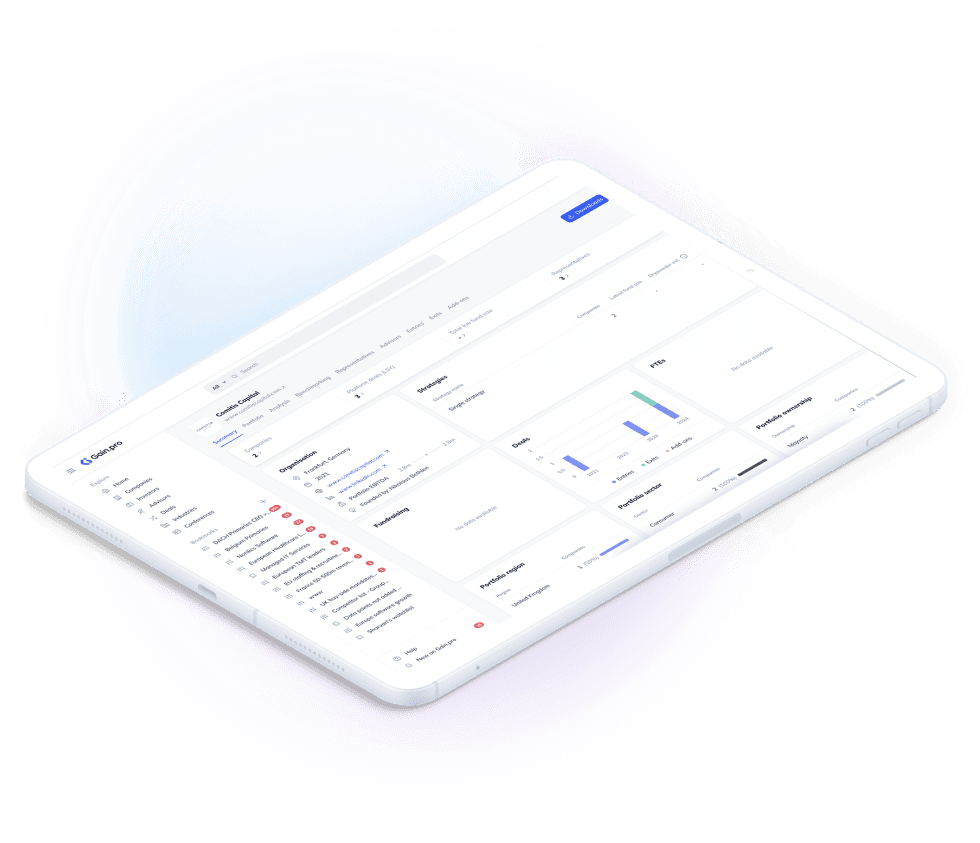

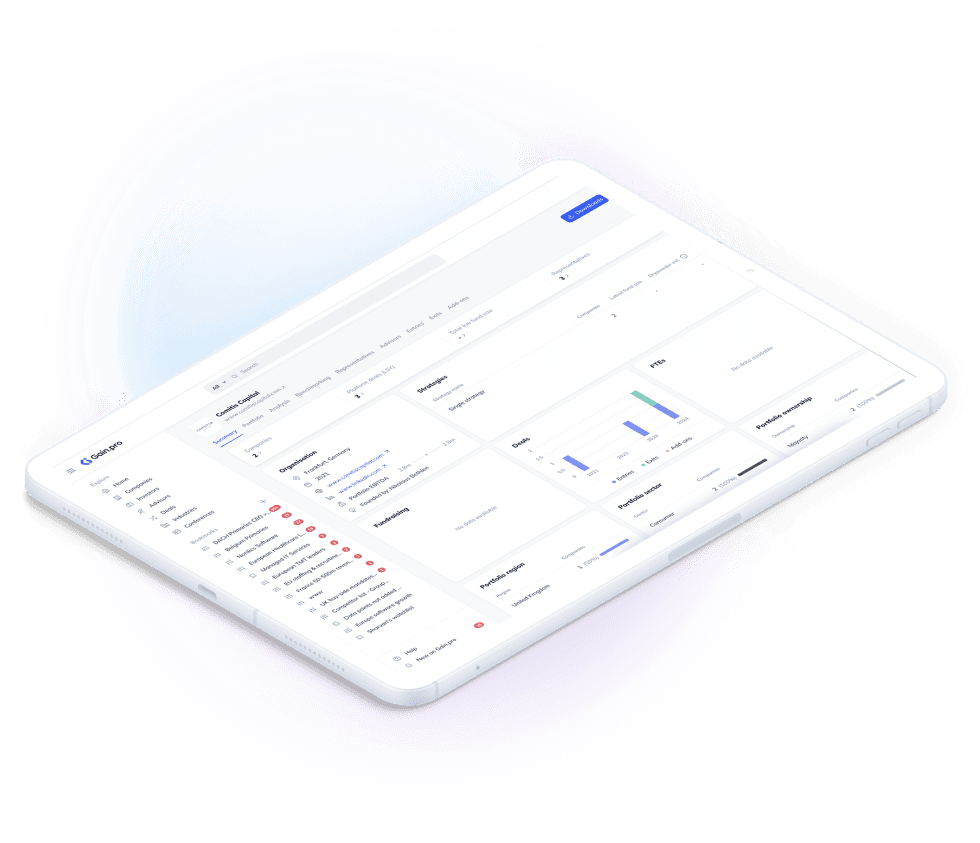

One of the primary ways Comitis Capital leverages Gain.pro is for proprietary deal sourcing, using the platform’s granular filter system to hone in on investment opportunities within their sweet spot. They do this by inputting specific keywords and filter criteria like financials, ownership type and geography into the platform to generate a list of highly relevant companies.

“We start by first identifying keywords that describe the sector we’re interested in, then plug them into Gain.pro. With the push of a button, we get a precise list of relevant players. From there, we can apply filters—like companies with EBITDA less than or equal to 20 million, and headquartered within certain geographies—so our base is essentially set.”

Felix Jauch

“We start by first identifying keywords that describe the sector we’re interested in, then plug them into Gain.pro. With the push of a button, we get a precise list of relevant players. From there, we can apply filters—like companies with EBITDA less than or equal to 20 million, and headquartered within certain geographies—so our base is essentially set.”

Felix Jauch

“We start by first identifying keywords that describe the sector we’re interested in, then plug them into Gain.pro. With the push of a button, we get a precise list of relevant players. From there, we can apply filters—like companies with EBITDA less than or equal to 20 million, and headquartered within certain geographies—so our base is essentially set.”

Felix Jauch

What differentiates Gain.pro’s deal sourcing capabilities from other platforms is its intuitive interface that not only allows you to search using a highly specific set of criteria, but to conduct semantic searches.

What differentiates Gain.pro’s deal sourcing capabilities from other platforms is its intuitive interface that not only allows you to search using a highly specific set of criteria, but to conduct semantic searches.

What differentiates Gain.pro’s deal sourcing capabilities from other platforms is its intuitive interface that not only allows you to search using a highly specific set of criteria, but to conduct semantic searches.

“In other platforms, I’d have to think about different sector codes and various other details. But with Gain.pro, I can simply type in something like ‘compliance software’ or ‘SAP consulting providers,’ and it generates a list of players.”

Felix Jauch

“In other platforms, I’d have to think about different sector codes and various other details. But with Gain.pro, I can simply type in something like ‘compliance software’ or ‘SAP consulting providers,’ and it generates a list of players.”

Felix Jauch

“In other platforms, I’d have to think about different sector codes and various other details. But with Gain.pro, I can simply type in something like ‘compliance software’ or ‘SAP consulting providers,’ and it generates a list of players.”

Felix Jauch

The team at Comitis Capital also finds Gain.pro’s Similar Companies feature valuable in finding relevant companies. This functionality uses artificial intelligence to generate a list of complementary businesses based on tags.

This ease of use, combined with Gain.pro’s smart filter system, has helped streamline Comitis Capital’s internal deal sourcing process.

“Gain.pro is super intuitive, super fast, and it gives us a great starting point for origination.”

Felix Jauch

“Gain.pro is super intuitive, super fast, and it gives us a great starting point for origination.”

Felix Jauch

“Gain.pro is super intuitive, super fast, and it gives us a great starting point for origination.”

Felix Jauch

Discovering and Understanding Niche Industries

Discovering and Understanding Niche Industries

Discovering and Understanding Niche Industries

Comitis Capital also leverages Gain.pro to quickly get up to speed on niche industries, including those that may not have previously been on their radar. The platform’s comprehensive industry reports provide information and insights on:

Comitis Capital also leverages Gain.pro to quickly get up to speed on niche industries, including those that may not have previously been on their radar. The platform’s comprehensive industry reports provide information and insights on:

Comitis Capital also leverages Gain.pro to quickly get up to speed on niche industries, including those that may not have previously been on their radar. The platform’s comprehensive industry reports provide information and insights on:

Specific segments

Market outlook

ESG ratings

Analyst assessments

Active investors and advisors

And more

These reports are also packed with proprietary insights curated through C-level interviews, providing a wealth of information that helps the team gain an inside perspective on industries.

These reports are also packed with proprietary insights curated through C-level interviews, providing a wealth of information that helps the team gain an inside perspective on industries.

These reports are also packed with proprietary insights curated through C-level interviews, providing a wealth of information that helps the team gain an inside perspective on industries.

“Industry reports are really useful for giving us new insights and ideas. If we come across an interesting report on a sector we haven’t looked at before, it prompts us to try to understand it better. That’s been super helpful for us.”

Felix Jauch

“Industry reports are really useful for giving us new insights and ideas. If we come across an interesting report on a sector we haven’t looked at before, it prompts us to try to understand it better. That’s been super helpful for us.”

Felix Jauch

“Industry reports are really useful for giving us new insights and ideas. If we come across an interesting report on a sector we haven’t looked at before, it prompts us to try to understand it better. That’s been super helpful for us.”

Felix Jauch

For Comitis Capital, these reports are also a valuable starting point for identifying potential investment opportunities within a sector. By filtering the list of companies within the industry, they can easily discover new targets that align with their investment criteria.

Once identified, the team can save their search criteria as a Bookmark so they can track the companies and receive updates when new companies are added to the list or when financials are updated. These Bookmarks allow Comitis Capital to take a proactive approach to their deal sourcing.

For Comitis Capital, these reports are also a valuable starting point for identifying potential investment opportunities within a sector. By filtering the list of companies within the industry, they can easily discover new targets that align with their investment criteria.

Once identified, the team can save their search criteria as a Bookmark so they can track the companies and receive updates when new companies are added to the list or when financials are updated. These Bookmarks allow Comitis Capital to take a proactive approach to their deal sourcing.

For Comitis Capital, these reports are also a valuable starting point for identifying potential investment opportunities within a sector. By filtering the list of companies within the industry, they can easily discover new targets that align with their investment criteria.

Once identified, the team can save their search criteria as a Bookmark so they can track the companies and receive updates when new companies are added to the list or when financials are updated. These Bookmarks allow Comitis Capital to take a proactive approach to their deal sourcing.

“We usually create bookmarks for a subsector with the relevant players, giving us a clear overview of the companies. We also get notifications when there are new financial updates or when other important changes occur.”

Felix Jauch

“We usually create bookmarks for a subsector with the relevant players, giving us a clear overview of the companies. We also get notifications when there are new financial updates or when other important changes occur.”

Felix Jauch

“We usually create bookmarks for a subsector with the relevant players, giving us a clear overview of the companies. We also get notifications when there are new financial updates or when other important changes occur.”

Felix Jauch

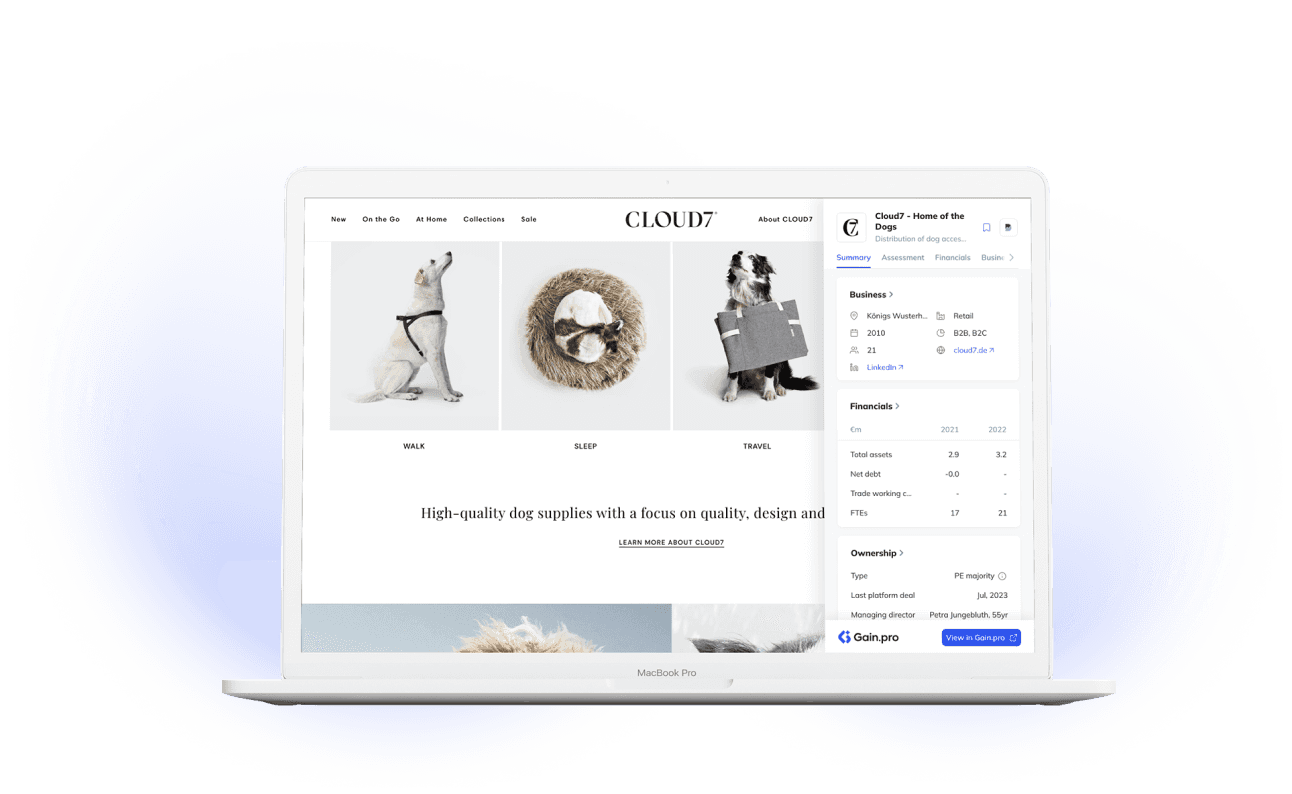

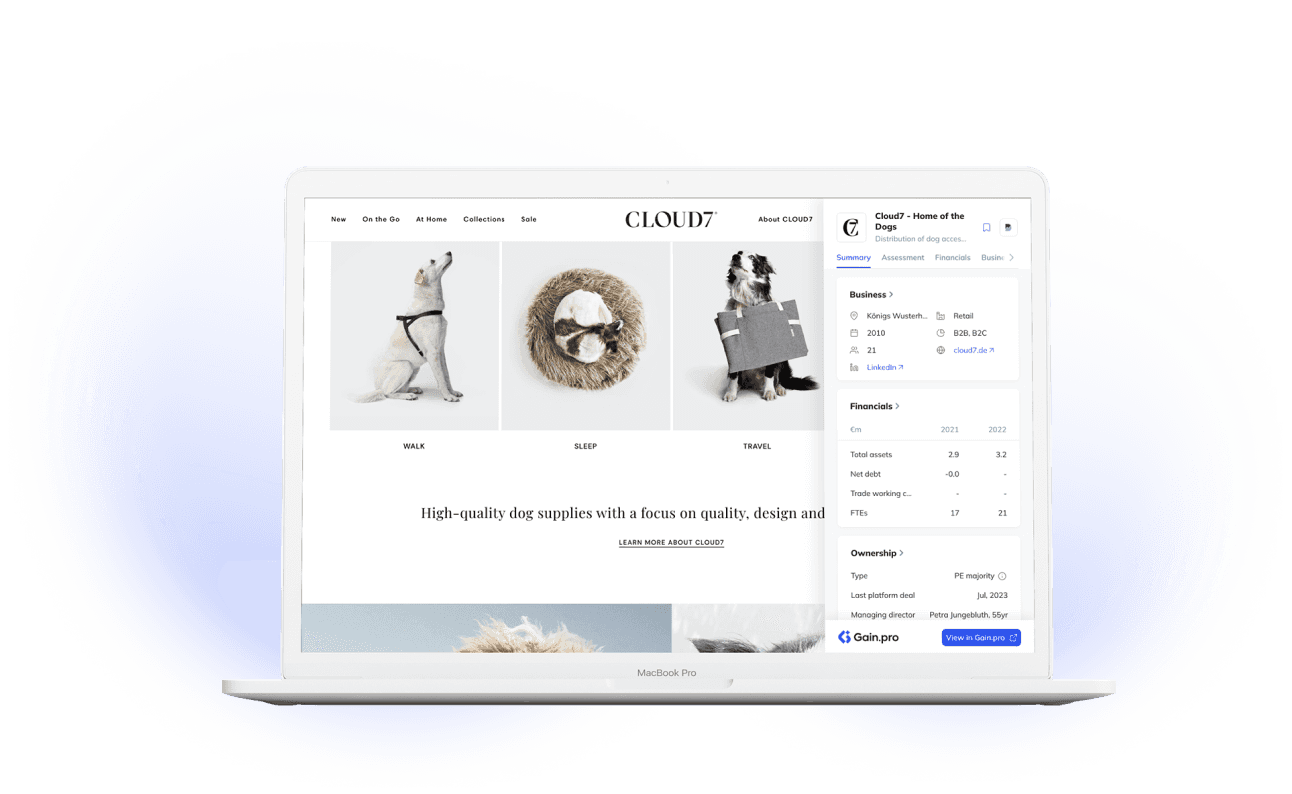

Researching with the Browser Extension

Researching with the Browser Extension

Researching with the Browser Extension

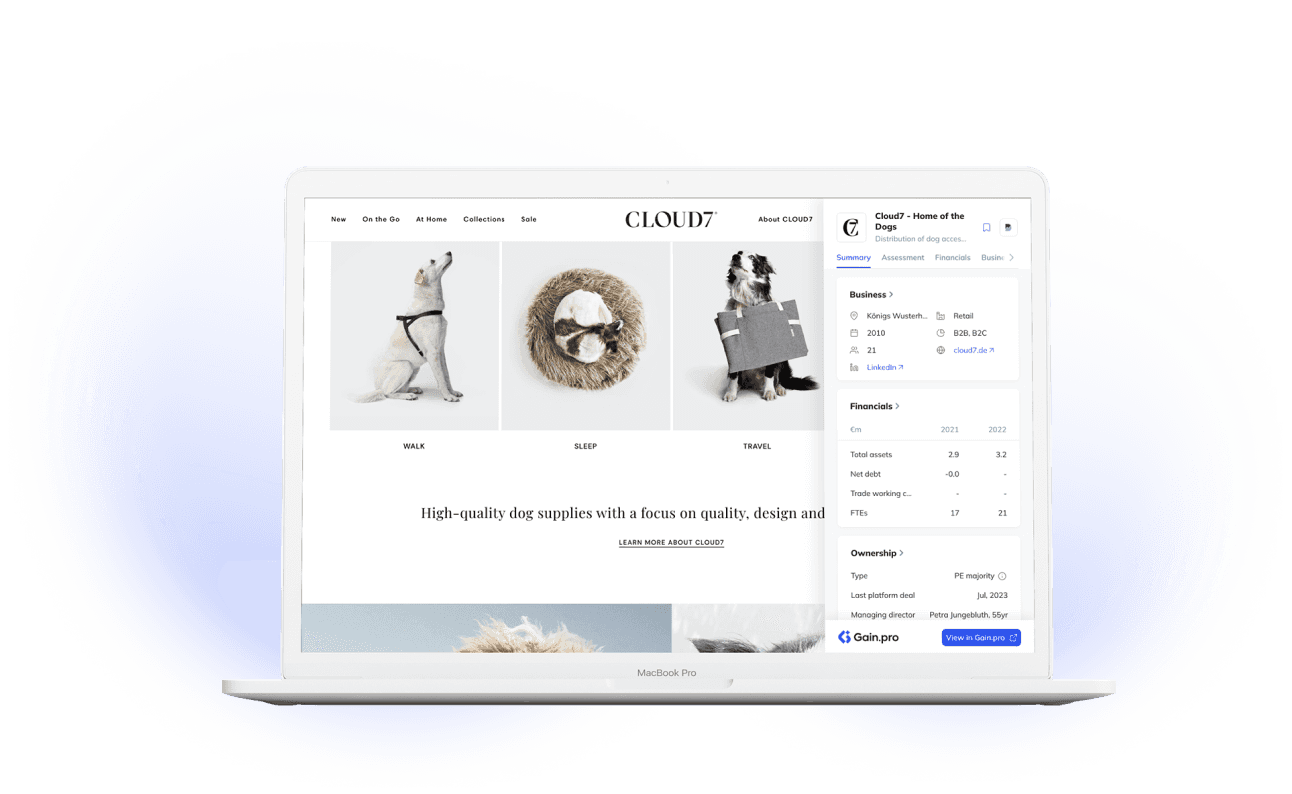

When browsing the web, Comitis Capital makes the most out of Gain.pro’s browser extension to quickly gain a view of a company without leaving its webpage. The extension allows them to easily access key company information directly from Gain.pro without having to switch between tabs. This streamlined workflow has significantly enhanced their efficiency when reviewing potential opportunities.

“When you visit a website, the Gain.pro plugin pops up, allowing you to see information on financials, ownership and more straight away. This is incredibly helpful for us because, previously, it involved several steps: we’d find the relevant players, plug them into Excel, visit the website to copy the legal company name, and then input that into a traditional database to look for additional financial and ownership information. Now, we can just visit the website and get an overview immediately. It’s super convenient and saves us many hours each month.”

Felix Jauch

“When you visit a website, the Gain.pro plugin pops up, allowing you to see information on financials, ownership and more straight away. This is incredibly helpful for us because, previously, it involved several steps: we’d find the relevant players, plug them into Excel, visit the website to copy the legal company name, and then input that into a traditional database to look for additional financial and ownership information. Now, we can just visit the website and get an overview immediately. It’s super convenient and saves us many hours each month.”

Felix Jauch

“When you visit a website, the Gain.pro plugin pops up, allowing you to see information on financials, ownership and more straight away. This is incredibly helpful for us because, previously, it involved several steps: we’d find the relevant players, plug them into Excel, visit the website to copy the legal company name, and then input that into a traditional database to look for additional financial and ownership information. Now, we can just visit the website and get an overview immediately. It’s super convenient and saves us many hours each month.”

Felix Jauch

With the Gain.pro browser extension, the team can instantly access detailed company information and data, including:

With the Gain.pro browser extension, the team can instantly access detailed company information and data, including:

With the Gain.pro browser extension, the team can instantly access detailed company information and data, including:

Concise business description

Cleaned financials

Analyst assessments

Ownership information

And more

Directly from the browser extension, they can save the company profile on Gain.pro for further research later on.

Directly from the browser extension, they can save the company profile on Gain.pro for further research later on.

Directly from the browser extension, they can save the company profile on Gain.pro for further research later on.

Benefits of Leveraging Gain.pro

Benefits of Leveraging Gain.pro

Benefits of Leveraging Gain.pro

Since adopting Gain.pro, Comitis Capital has experienced substantial efficiency gains. Most notably, their proprietary deal sourcing process has become faster and more streamlined, allowing them to identify relevant investment opportunities with greater ease. The team is also able to get up to speed on niche industries more efficiently with the platform's deep dive reports.

“We’ve seen significant efficiency gains in our proprietary sourcing approach, as well as in gaining insights into industries. As a result, we’ve had more time to focus on tasks that add real value instead of spending many hours conducting research or compiling lists.”

Felix Jauch

“We’ve seen significant efficiency gains in our proprietary sourcing approach, as well as in gaining insights into industries. As a result, we’ve had more time to focus on tasks that add real value instead of spending many hours conducting research or compiling lists.”

Felix Jauch

“We’ve seen significant efficiency gains in our proprietary sourcing approach, as well as in gaining insights into industries. As a result, we’ve had more time to focus on tasks that add real value instead of spending many hours conducting research or compiling lists.”

Felix Jauch

Additionally, Gain.pro has empowered the team to engage in meaningful conversations with companies. “Even as a small team, we can move faster, avoid hierarchies and still maintain the knowledge and speed of a bigger firm, while benefiting from the fast decision-making of a smaller team.” - Felix Jauch

Overall, Gain.pro has given Comitis Capital a competitive edge by enabling them to be efficient in their operation while also playing to their own strengths, like agility and flexibility.

"Even as a small team, we can move faster, avoid hierarchies and still maintain the knowledge and speed of a bigger firm, while benefiting from the fast decision-making of a smaller team.”

Felix Jauch

"Even as a small team, we can move faster, avoid hierarchies and still maintain the knowledge and speed of a bigger firm, while benefiting from the fast decision-making of a smaller team.”

Felix Jauch

"Even as a small team, we can move faster, avoid hierarchies and still maintain the knowledge and speed of a bigger firm, while benefiting from the fast decision-making of a smaller team.”

Felix Jauch

The Role of Technology in Private Equity

The Role of Technology in Private Equity

The Role of Technology in Private Equity

As technology plays an increasingly important role in shaping the future of private equity, it enables firms to enhance efficiency and focus on the elements that differentiate themselves in a competitive landscape. At Comitis Capital, digital platforms like Gain.pro have already made a profound impact.

“I believe that digital platforms like Gain.pro can create immense efficiency gains for private equity professionals. There are many tasks that have been automated, allowing us to focus on the value-creating and creative aspects of our work as well as spending more time with our entrepreneurs. This means we can concentrate on our key strengths.”

Felix Jauch

“I believe that digital platforms like Gain.pro can create immense efficiency gains for private equity professionals. There are many tasks that have been automated, allowing us to focus on the value-creating and creative aspects of our work as well as spending more time with our entrepreneurs. This means we can concentrate on our key strengths.”

Felix Jauch

“I believe that digital platforms like Gain.pro can create immense efficiency gains for private equity professionals. There are many tasks that have been automated, allowing us to focus on the value-creating and creative aspects of our work as well as spending more time with our entrepreneurs. This means we can concentrate on our key strengths.”

Felix Jauch

By building a strong tech stack early in their journey, Comitis Capital is positioning themselves for long-term success. They are not only increasing efficiency but also future-proofing their operations to stay competitive as digital solutions evolve.

Read more customer stories

Read more customer stories

Read more customer stories

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Join the digital revolution in private market intelligence

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved

Product

Resources

Reports

© 2025 Gain.pro, all rights reserved